Garmin (GRMN) Q1 Earnings & Sales Beat Estimates, Rise Y/Y

Garmin Ltd. GRMN has reported first-quarter 2024 pro-forma earnings of $1.42 per share, beating the Zacks Consensus Estimate by 42%. The bottom line improved on a year-over-year basis.

Net sales were $1.38 billion, which surpassed the Zacks Consensus Estimate of $1.24 billion. The figure increased 20% from the year-ago quarter.

Year-over-year growth in the top line was attributed to strength in the Fitness and Auto OEM segments. The growing Outdoor and Marine segments contributed well.

Shares of Garmin have gained 13% year to date, outperforming the industry’s rally of 7.2%.

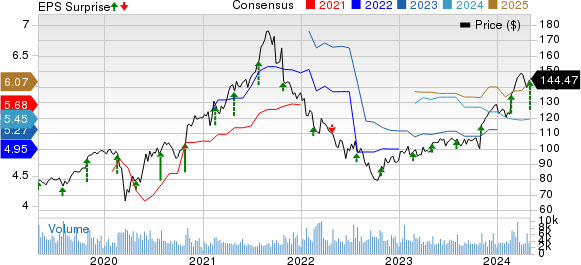

Garmin Ltd. Price, Consensus and EPS Surprise

Garmin Ltd. price-consensus-eps-surprise-chart | Garmin Ltd. Quote

Segmental Details

Outdoor (26.5% of net sales): The segment generated sales of $366.2 million in the reported quarter, increasing 11% year over year due to strength in the wearables category.

Fitness (24.8%): The segment generated sales of $342.9 million, which increased 40% from the year-ago quarter, owing to solid demand for the company’s advanced wearables.

Aviation (15.7%): The segment generated sales of $216.9 million, increasing 2% on a year-over-year basis. This was driven by the solid momentum in OEM product categories.

Marine (23.6%): Garmin generated sales of $326.7 million from the segment, increasing 17% on a year-over-year basis. This was driven by benefits from the JL Audio buyout.

Auto OEM (9.4%): The segment generated sales of $128.9 million, up 58% from the prior-year quarter. This was primarily attributed to growing shipments of domain controllers to BMW.

Operating Results

In the first quarter, the gross margin was 58.1%, which expanded 120 basis points (bps) from the year-ago period.

Garmin’s operating expenses of $503.7 million were up 10.5% from the prior-year quarter due to rising personnel costs. As a percentage of revenues, the figure contracted 320 bps year over year to 36.5%.

The operating margin was 21.6% in the reported quarter, which expanded 440 bps year over year.

Balance Sheet & Cash Flow

As of Dec 30, 2023, cash, cash equivalents and marketable securities were $2.2 billion, down from $3.1 billion as of Dec 30, 2023.

In the first quarter of 2024, Garmin generated an operating cash flow of $435.3 million and a free cash flow of $402 million.

The company paid out a quarterly dividend of approximately $140 million.

2024 Guidance

Garmin has reiterated its 2024 revenue guidance at $5.75 billion. The Zacks Consensus Estimate for 2024 net sales is pegged at $5.77 billion.

The company expects pro-forma earnings of $5.40 per share. The consensus mark for 2024 earnings is pegged at $5.45 per share.

Zacks Rank & Other Stocks to Consider

Currently, Garmin carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are Arista Networks ANET, Badger Meter BMI and Dell Technologies DELL. Arista Networks and Badger Meter sport a Zacks Rank #1 (Strong Buy) at present, and Dell Technologies carries Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Arista Networks have gained 4.2% in the year-to-date period. The long-term earnings growth rate for ANET is 17.48%.

Shares of Badger Meter have gained 17.5% in the year-to-date period. The long-term earnings growth rate for BMI is 15.57%.

Shares of Dell Technologies have gained 52.3% in the year-to-date period. The long-term earnings growth rate for DELL is projected at 12%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經