Home Depot (HD) Buys SRS Distribution, Reaches $1 Trillion TAM

The Home Depot Inc. HD has completed its previously announced acquisition of SRS Distribution, a leading specialty trade distribution company across several verticals. Per the acquisition pact signed on Mar 28, 2024, Home Depot bought the latter for an enterprise value of $18.25 billion, including net debt. The company funded the acquisition through cash on hand and debt.

The acquisition is likely to expand Home Depot’s total addressable market (“TAM”) to $1 trillion, marking an increase of $50 billion. The addition of SRS to HD’s business is expected to accelerate growth of its Pro business, providing residential professional customers with more fulfillment and service options than before.

SRS's outstanding customer service, capabilities and expertise rightly complement Home Depot's distribution capabilities. The union of the two companies is expected to enhance Home Depot’s ability to serve the complex purchase occasion and establish it as a leading specialty trade distributor across multiple verticals.

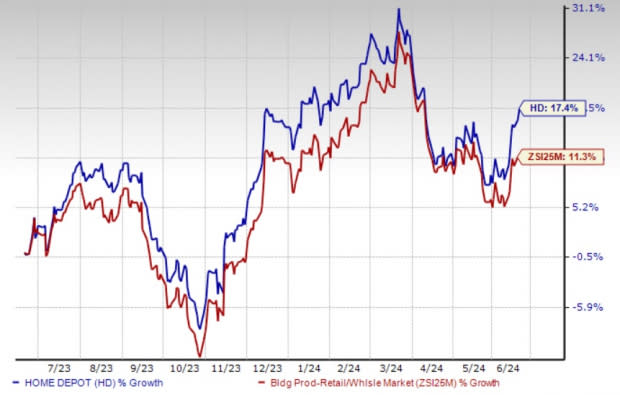

Shares of Home Depot rose 1.3% following the announcement of the SRS Distribution acquisition on Jun 18, 2024. Moreover, the Zacks Rank #3 (Hold) company has rallied 17.4% in the year compared with the industry’s growth of 11.3%.

Image Source: Zacks Investment Research

Home Depot’s Growth Plan on Track

HD is well on track with its investments to strengthen its business despite the recent softness in demand trends across the home improvement industry. Home Depot is witnessing significant benefits from the execution of its strategic initiatives and commitment to investing in the business to deliver the best interconnected shopping experience, capture wallet share with the Pro and expand its store footprint.

The company is progressing well with the execution of the “One Home Depot” investment plan, which focuses on expanding supply-chain facilities, technology investments and enhancement to the digital experience. The interconnected retail strategy and underlying technology infrastructure have helped consistently boost web traffic for the past few quarters.

Home Depot’s Pro segment has been a key growth driver, witnessing robust sales growth for the past several quarters. In first-quarter fiscal 2024, the company’s Pro and DIY sales were almost in line with one another. Although lower than the year-ago quarter, the company noted that Pro backlogs continued to be healthy and elevated relative to historic trends.

Recent external data point suggests that the types of projects in these backlogs are changing from large-scale remodels to smaller projects. HD continues to invest in Pro capabilities like enhanced fulfillment, more personalized online experience and other business management tools to drive deeper engagement with Pro customers.

By the end of fiscal 2024, the company expects to equip 17 of its top Pro markets with new fulfillment options, localized product assortment and expanded sales force, along with enhanced digital capabilities with trade credit and order management in pilot for development.

Key Picks

Some better-ranked stocks are Abercrombie & Fitch ANF, The Gap Inc. GPS and Canada Goose GOOS.

Abercrombie, a specialty retailer of premium, high-quality casual apparel for men, women and kids, currently flaunts a Zacks Rank #1 (Strong Buy). ANF has a trailing four-quarter earnings surprise of 210.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANF’s current financial-year sales and earnings indicates growth of 10.4% and 47.3%, respectively, from the year-ago reported numbers.

Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. It sports a Zacks Rank #1 at present.

The Zacks Consensus Estimate for Gap’s current financial-year sales and earnings indicates growth of 0.2% and 21.7%, respectively, from the year-ago reported numbers. GPS has a trailing four-quarter earnings surprise of 202.7%, on average.

Canada Goose is a global outerwear brand. It currently flaunts a Zacks Rank #1. GOOS has a trailing four-quarter average earnings surprise of 70.9%.

The Zacks Consensus Estimate for Canada Goose’s current fiscal-year earnings indicates growth of 13.7% from the previous year’s reported figure. Meanwhile, the consensus estimate for the current fiscal year suggests flat year-over-year sales of $986.2 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經