House prices likely to rise more slowly than household incomes, says Zoopla

Property values are likely to rise more slowly than incomes over the next couple of years, with the typical house price currently sitting at nearly £20,000 above the level that would generally be affordable to households, according to Zoopla.

However, rising incomes and longer mortgage terms are helping to improve affordability, meaning the “over-valuation” of properties is expected to have disappeared by the end of the year, the website said.

Zoopla’s over-valuation estimate was reached by comparing the actual average house price in its index with an “affordable” price, which was calculated based on households’ disposable incomes, average mortgage rates and average deposit sizes for home buyers.

Its report said: “House prices still look expensive on various measures of affordability.

“We expect house price inflation to remain muted, likely to rise more slowly than household incomes over the next one to two years.”

Zoopla said the average house price is around £264,900 – but according to its calculations, the affordable price is £245,200 – making the average home nearly £20,000 over-valued.

The website added that around three-quarters (75%) of the 1.1 million home sales it expects to take place this year are either complete or already in the sales pipeline.

The 1.1 million sales expected would be 10% higher than the total for 2023 but still below the 20-year average, Zoopla said.

Its report said: “It is positive that sales are rising despite higher borrowing costs and shows more realism on the part of sellers and renewed, cautious confidence amongst buyers.”

The over-valuation in property prices seen towards the end of 2023 and early 2024 is less severe than in the run-up to the financial crisis in the late 2000s and the late 1980s housing market “bubble”, Zoopla said.

Its report said: “Faster wage growth over the last three years has boosted household disposable incomes and helped offset some of the impact of higher mortgage rates.”

Richard Donnell, executive director at Zoopla, said: “The housing market continues to adjust to higher borrowing costs through modest house price falls and rising incomes.

“Buyers using mortgages are also relying on longer mortgage terms to gain that extra few percentage points of buying power to afford a home.

“The General Election campaign has had a limited impact on market activity although the seasonal summer slowdown is arriving.

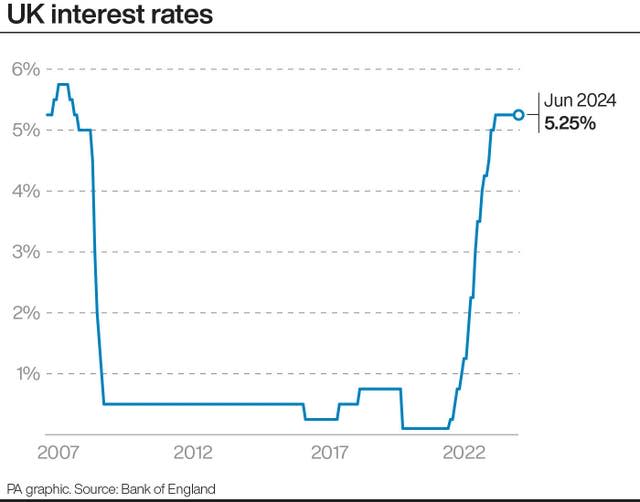

“Sales agreed continued to increase and more homes for sale means more buyers looking to move in the second half of the year. The timing of the first cut in the (Bank of England) base rate is a key moment and will give a boost to both market sentiment and sales activity.”

Tom Bill, head of UK residential research at estate agent Knight Frank, said: “A new government will add a dimension of political stability when the autumn market starts in September and even if the (Bank of England base) rate is not lower by then, a cut will be imminent.

“Given that mortgage rates will steadily reduce as services inflation comes under control, we expect UK house prices to rise by 3% this year.”

Matt Thompson, head of sales at estate agent Chestertons said: “We are now in the last days of the typically busy spring market and are seeing a bounce in buyer activity.

“As the date for the General Election was announced, house hunters who have been on the fence due to political uncertainty have become more confident about going ahead with their purchase. As a result, we expect June to conclude with a heightened level of buyer interest.”

Myles Moloney, area sales manager at estate agent Chase Buchanan, said: “June’s property market to date has remained positive and house hunters with larger equity and buying power have pushed on to agree a sale.”

雅虎香港財經

雅虎香港財經