Indonesia Holds Rate, Vows Steps to Get Rupiah Below 16,000

(Bloomberg) -- Indonesia’s central bank left its benchmark interest rate unchanged for a second straight meeting, while pledging further intervention to anchor the rupiah in the face of domestic and foreign pressures.

Most Read from Bloomberg

Putin’s Hybrid War Opens a Second Front on NATO’s Eastern Border

Hedge Fund Talent Schools Are Looking for the Perfect Trader

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

Bank Indonesia kept the BI-Rate at 6.25% on Thursday as predicted by 30 of 33 economists in a Bloomberg survey. The others expected an increase of 25 basis points.

While it stood pat, Governor Perry Warjiyo said in a briefing that the policy rate is “supported by strengthening monetary operations to bolster the effectiveness of rupiah stabilization and the inflow of foreign capital.” BI will continue intervening in the spot, derivatives and bond markets to smooth out volatility, as also issue securities at attractive yields to bring in more foreign fund flows, he said.

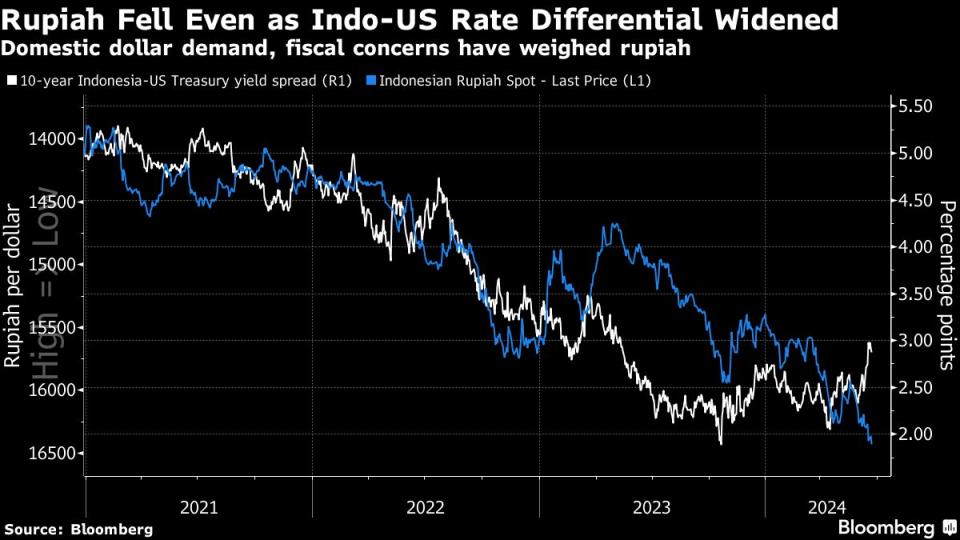

These measures should be adequate to return the rupiah to its “fundamental level,” stronger than 16,000 a dollar, aided by the nation’s steady growth, low inflation and attractive asset returns, Warjiyo said. He attributed the recent currency weakness to corporate demand for dollars and investor concerns about Indonesia’s fiscal outlook.

The latest pronouncements show BI may be viewing any further rate hikes as a last resort to protect the growth momentum of Southeast Asia’s largest economy, especially since inflation remains well within target. The governor even noted there was room for monetary easing if there were no headwinds from global market uncertainty and domestic fiscal concerns.

The rupiah extended an earlier loss after the decision, to close 0.4% weaker at 16,430 per dollar. The yield on five-year bonds were little changed at 7.02%.

“Today’s meeting is not hawkish enough to address recent rupiah weakening pressure,” said Wee Khoon Chong, a senior Asia Pacific markets strategist at BNY Mellon in Hong Kong. While seasonal factors like companies’ repatriation of dividends would fade, uncertainty over Indonesia’s fiscal policy could linger until later this year, he said. “BI is in a delicate position at the moment.”

The rupiah weakened past the 16,300-a-dollar waterline that policymakers marked last week as investors fretted over reports that incoming President Prabowo Subianto may increase Indonesia’s debt ratios to fund his populist campaign promises. That adds to risk aversion around the US Federal Reserve’s easing pivot and continued geopolitical tensions. The local currency is by far Asia’s worst performer so far this month, with a 1.1% loss against the greenback.

If the dollar index does not fall in coming days, “policymakers should be wary of FX and bond ‘vigilantes’ that could exert further pressures to IDR,” said Satria Sambijantoro, head of research at PT Bahana Sekuritas in Jakarta. “These speculators know that FX and bond interventions have limits.”

Growth Caution

The central bank avoided any mention of further tightening on Thursday as policymakers signaled they would take “cautious” policy steps in support of Indonesia’s economy. BI retained its forecast for the nation’s gross domestic product growth at 4.7%-5.5% this year, even though it raised the outlook for global expansion.

Despite the benchmark rate at its highest since it was introduced in 2016, credit growth stood at 12.15% year-on-year in May, as corporates pursued capital expenditure and households continued spending. Loan growth will likely come in at the higher end of BI’s 10%-12% target this year, Warjiyo said.

PT Bank Danamon’s Hosianna Evalia Situmorang expects BI to maintain the key rate throughout this year and begin cutting in the first quarter of 2025 after the Fed pivots. “We anticipate potential strengthening of the rupiah, supported by declining inflation in the US and easing geopolitical tensions. We expect that the rupiah’s depreciation is nearing its peak.”

--With assistance from Claire Jiao, Norman Harsono, Tomoko Sato and Rachel Cicilia.

(Updates throughout with comments from briefing, context)

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.

雅虎香港財經

雅虎香港財經