Iovance (IOVA) Up 5% on Updated Data From Melanoma Study

Iovance Biotherapeutics IOVA announced updated clinical results from a cohort of the phase II IOV-COM-202 study evaluating the combination of its recently approved cell therapy Amtagvi and Merck’s blockbuster oncology drug Keytruda in frontline advanced melanoma.

Based on a recent data cut that included 23 patients, treatment with the Amtagvi/Keytruda combo achieved a confirmed objective response rate (ORR) of 65.2%, including a complete responses (CR) rate of 30.4%. Management noted that ‘nearly all’ responses remained ongoing at a median follow-up of 21.7 months. All evaluable patients in the cohort also demonstrated regression of their target lesions.

Per management, these deep and durable response rates demonstrate the company’s strategy for the ongoing phase III TILVANCE-301 study evaluating the Amtagvi-Keytruda combo as a potential treatment for frontline advanced melanoma.

Some Wall Street analysts also pointed out that the above data showed significant improvement in response rates when compared to the current benchmark/standard of care treatments like Keytruda monotherapy or a combination of Bristol Myers drugs Opdivo and Yervoy.

Iovance intends to present these results at the 2024 ASCO Annual Meeting on May 31.

Following the announcement of the updated results, Iovance’s shares moved up more than 5% in after-market trading on May 23.

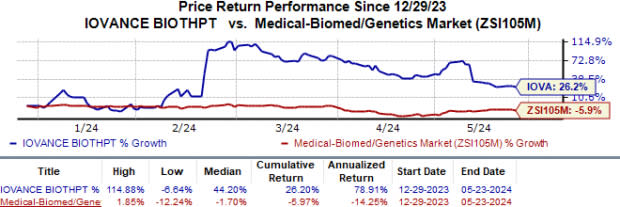

Year to date, the stock has soared 26.2% against the industry’s 6.0% fall.

Image Source: Zacks Investment Research

In February, Iovance received accelerated approval from the FDA for TIL therapy Amtagvi (lifileucel) for the treatment of adult patients with advanced melanoma, which progressed on or after prior anti-PD-1/L1 and targeted therapy. The TILVANCE study will also act as a confirmatory study seeking to convert this accelerated approval to a full one.

Following the nod, Amtagvi is the first and the only one-time T-cell therapy to be approved by the FDA for a solid tumor cancer and also the first treatment option in this melanoma indication. The drug has also been added as a preferred second-line or subsequent therapy in the National Comprehensive Cancer Network (NCCN) guidelines for the treatment of cutaneous melanoma.

Earlier this month, management provided an update on the commercial launch progress of Amtagvi. Per Iovance, more than 100 patients have enrolled for Amtagvi across more than 40 authorized treatment centers (ATCs). Management also claimed that it has experienced demand for the therapy growing every month since approval. It expects this demand to increase further throughout the year, driven by patient enrollments. During the conference call, CEO Fred Vogt mentioned that more than 60 additional patients have been identified at ATCs and are expected to enroll soon.

Iovance only had 30 ATCs onboard when Amtagvi was approved. Being the key driver of demand and patient enrolments for Amtagvi, management is focused on onboarding more ATCs. While the company is on track to onboard nearly 50 ATCs by this month’s end, it expects to close the year with at least 70 ATCs.

Regulatory applications for Amtagvi in melanoma indication in Europe and Canada are expected to be filed later this year.Filings in Australia and additional countries with significant populations of advanced melanoma patients are expected next year.

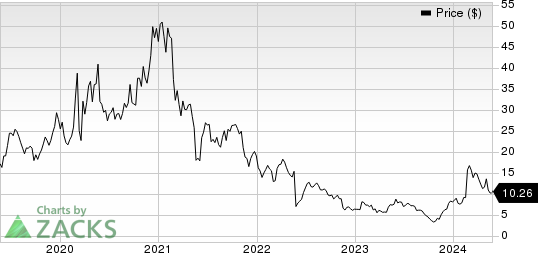

Iovance Biotherapeutics, Inc. Price

Iovance Biotherapeutics, Inc. price | Iovance Biotherapeutics, Inc. Quote

Zacks Rank & Key Picks

Iovance currently carries a Zacks Rank #3 (Buy). Some better-ranked stocks in the overall healthcare sector include Arcutis Biotherapeutics ARQT, Marinus Pharmaceuticals MRNS and Heron Therapeutics HRTX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ 2024 loss per share have narrowed from $2.49 to $1.60. During the same period, the loss estimates per share for 2025 have improved from $1.77 to $1.14. Year to date, shares of Arcutis have surged 181.1%.

Earnings of Arcutis Biotherapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. Arcutis delivered a four-quarter average earnings surprise of 14.93%.

In the past 60 days, estimates for Marinus Pharmaceuticals’ 2024 loss per share have improved from $2.44 to $1.87. During the same period, loss estimates for 2025 have narrowed from $1.97 to 90 cents.

Earnings of Marinus Pharmaceuticals beat estimates in two of the last four quarters and met the mark on one occasion while missing the mark on another. Marinus delivered a four-quarter average earnings surprise of 3.27%.

In the past 60 days, estimates for Heron Therapeutics’ 2024 loss per sharehave improved from 22 cents to 10 cents. During the same period, estimates for 2025 have improved from a loss of 9 cents to earnings of 1 cent. Year to date, HRTX’s shares have skyrocketed 104.1%.

Earnings of Heron Therapeutics beat estimates in three of the last four quarters while missing the mark on one occasion. HRTX delivered a four-quarter average earnings surprise of 30.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Heron Therapeutics, Inc. (HRTX) : Free Stock Analysis Report

Marinus Pharmaceuticals, Inc. (MRNS) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report

Arcutis Biotherapeutics, Inc. (ARQT) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經