LyondellBasell (LYB) Partners CORADIN & Dermalogica for Packaging

LyondellBasell Industries N.V. LYB recently partnered with CORADIN and Dermalogica to develop a more sustainable solution for the Greenis Dispenser, utilizing its CirculenRecover solution in the award-winning packaging. The best Post-Consumer Resin (PCR) for this cosmetics application, which required both functionality and aesthetics, was chosen by LYB in collaboration with CORADIN and Dermalogica.

LYB provided a high-quality solution in the form of CirculenRecover polypropylene polymer, which is manufactured from plastic waste via a mechanical recycling process. This solution struck an ideal combination of performance, aesthetics and recycled content. The new Greenis Dispenser, which contains more than 75% PCR, has won multiple honors, including the World Star Winner 2024 Award in the Health & Personal Care category, for its recyclability, sustainability, ergonomics and waste reduction capabilities.

The Greenis Dispenser demonstrates how recycled material can replace traditional fossil-based feedstock, enhancing circularity and environmental performance in the packaging sector. This partnership exemplifies what collaborative efforts can do in the industry — a more sustainable, high-quality, lightweight, user-friendly, and e-commerce-friendly award-winning product with a lower usage of fossil resources. LyondellBasell, through this partnership, can contribute to the elimination of plastic waste in the environment and the development of solutions for everyday sustainable living.

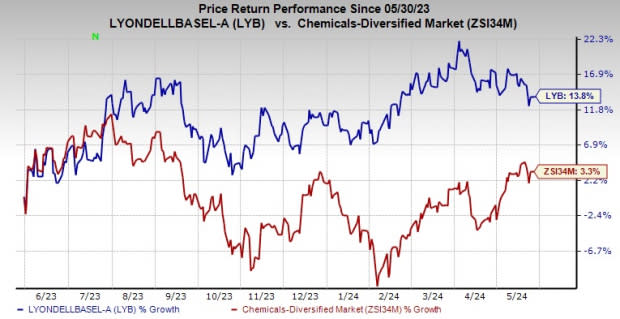

Shares of LyondellBasell have gained 13.8% over the past year compared with a 3.3% rise of its industry.

Image Source: Zacks Investment Research

For the second quarter, the company anticipates seasonal demand to increase across most businesses. LYB's North American and Middle Eastern production will continue to benefit from low natural gas and NGL costs compared to higher oil-based costs in other regions.

As the summer driving season begins, oxyfuel and refining margins are likely to rise due to increased gasoline crack spreads and reduced butane costs. In the second quarter, LYB anticipates meeting market demand with average operating rates of 85% for global olefins and polyolefins assets and 80% for Intermediates & Derivatives assets.

LyondellBasell Industries N.V. Price and Consensus

LyondellBasell Industries N.V. price-consensus-chart | LyondellBasell Industries N.V. Quote

Zacks Rank & Key Picks

LyondellBasell currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include ATI Inc. ATI, Carpenter Technology Corporation CRS and Ecolab Inc. ECL.

ATI carries a Zacks Rank #1 (Strong Buy). ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company’s shares have soared 75.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.1%. The company’s shares have soared 145%% in the past year.

The Zacks Consensus Estimate for Ecolab’s current-year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. ECL, a Zacks Rank #2 (Buy) stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company’s shares have rallied roughly 37.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經