Parker-Hannifin (PH) Q3 Earnings Top Estimates, Sales View Up

Parker-Hannifin Corporation PH reported third-quarter fiscal 2024 (ended Mar 31, 2024) adjusted earnings (excluding 95 cents from non-recurring items) of $6.51 per share, which beat the Zacks Consensus Estimate of $6.10. The bottom line jumped 9.8% year over year.

Total revenues of $5.074 billion narrowly missed the Zacks Consensus Estimate of $5.076 billion. However, the top line increased 0.3% year over year. Strength across businesses and operational improvement drove the company’s top line. Organic sales grew 1.2% year over year. Orders were flat year over year.

Segmental Details

The Diversified Industrial segment’s revenues totaled $3.66 billion, representing 72.2% of net revenues for the quarter under review. On a year-over-year basis, the segment’s revenues decreased 5.2%.

Revenues generated in Diversified Industrial North America totaled $2.23 billion, down 5% year over year. The Zacks Consensus Estimate was pegged at $2.30 billion. Diversified International revenues were $1.43 billion, down 6% year over year. The consensus mark was pegged at $1.48 billion.

Orders for Diversified Industrial North America and Diversified Industrial International declined 4% and 8%, respectively, year over year.

The Aerospace Systems segment generated revenues of $1.41 billion, which accounted for 27.8% of net revenues for the reported quarter. Sales jumped 18% year over year, thanks to strong growth in orders. The Zacks Consensus Estimate was pegged at $1.31 billion. Orders for the Aerospace Systems unit increased 15% on a rolling 12-month average basis.

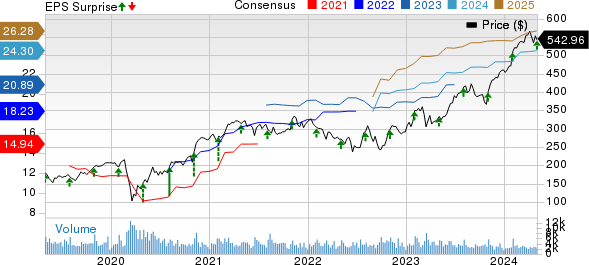

Parker-Hannifin Corporation Price, Consensus and EPS Surprise

Parker-Hannifin Corporation price-consensus-eps-surprise-chart | Parker-Hannifin Corporation Quote

Margin Profile

For the reported quarter, Parker-Hannifin’s cost of sales fell 1.8% year over year to $3.28 billion. Selling, general and administrative expenses decreased 6% from the prior year to $816.3 million.

Adjusted total segment operating income increased 6.5% year over year to $1.25 billion. Adjusted total segment operating margin increased 150 basis points year over year to 24.7%.

Balance Sheet & Cash Flow

Exiting the fiscal third quarter, Parker-Hannifin had cash and cash equivalents of $405.5 million compared with $475.2 million at the end of fiscal 2023.

Long-term debt was $7.29 billion compared with $8.80 billion at the end of fiscal 2023.

In the first nine months of fiscal 2024, PH generated net cash of $2.15 billion from operating activities compared with $1.79 billion in the year-ago period.

Capital spending totaled $283.3 million in the reported quarter compared with $272.6 million in the year-ago period.

In the first nine months of fiscal 2024, Parker-Hannifin paid out cash dividends of $571.6 million, up 11.4% year over year.

Fiscal 2024 Guidance Revised

PH expects total sales to increase 4% year over year compared with 3-5% anticipated earlier. Its total segment operating margin is estimated to be 21.2% (24.6% on an adjusted basis).

PH currently expects adjusted earnings of $24.65-$24.85 per share for fiscal 2024 compared with $23.90-$24.50 projected earlier.

Zacks Rank and Key Picks

PH currently carries a Zacks Rank #3 (Hold). Here are some better-ranked stocks from the same space:

Chart Industries GTLS presently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter average earnings surprise of 75.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GTLS’ 2024 earnings has increased 5.7% in the past 60 days.

Crane Company CR presently flaunts a Zacks Rank of 1. It delivered a trailing four-quarter average earnings surprise of 15.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has increased 4.9%.

Ingersoll Rand plc IR currently carries a Zacks Rank of 2 (Buy). IR delivered a trailing four-quarter average earnings surprise of 15.9%.

In the past 60 days, the Zacks Consensus Estimate for Ingersoll Rand’s 2024 earnings has increased 1.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Parker-Hannifin Corporation (PH) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經