POOL Gains From POOL360 Platform, Expansion Amid High Costs

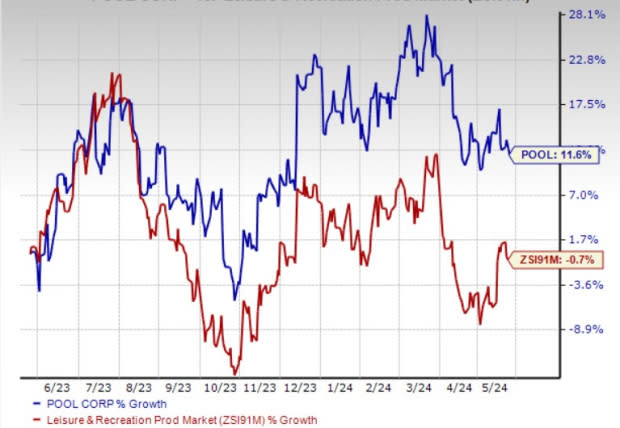

Pool Corporation POOL is benefiting from the POOL360 platform, expansion strategy and solid brand presence. Consequently, shares of the company have gained 11.6% in the past year against the industry’s decline of 0.7%.

However, softness in new pool construction and high costs remain a concern for the company. In the past 30 days, the Zacks Consensus Estimate for 2024 earnings has witnessed a downward revision of 1%. Let’s delve deeper.

Growth Drivers

The company emphasizes the POOL360 ecosystem to drive growth. In the first quarter, it reported strength in orders processed through the traditional B2B POOL360 platform. The platform contributed 11% to the company’s total sales compared with 10% in the prior year quarter. While still in the early stages, the company is witnessing positive effects from the POOL360 service tool, evidenced by volume growth in private-label chemical brands and revenue growth in other product lines.

The company reported progress in the POOL360 water test with the customer base more than doubling from 2023 levels. Analysis of customer purchasing behavior revealed a notable increase in private-label chemical purchases among POOL360 water test customers compared with the rest of the customer base. Given the positive feedback, the company is optimistic and anticipates the collaborative efforts of its sales field and technology teams to deploy the new software and spur growth.

Pool focuses on expansion to drive revenues. It is foraying into newer geographic locations, expanding existing markets and launching innovative product categories to boost market share. It is also trying to expand through various acquisitions.

In the first quarter of 2024, the company unveiled three new locations and acquired one, thereby increasing the total sales center network to 442 locations. Additionally, the Pinch A Penny franchise network added five new stores (with two of them strategically added as part of the expansion in the Texas market), thereby bringing the total franchise locations to 290.

This Zacks Rank #3 (Hold) company benefits from its market-leading position that offers a cost advantage and allows it to generate a higher return on investment than smaller companies. Further, the housing market continues to boost demand for Pool’s products despite numerous competitors and low barriers to entry.

Image Source: Zacks Investment Research

Concerns

Softness in new pool construction remains a concern for the company. During the first quarter, the company’s operations were impacted by lower sales volume courtesy of reduced pool construction and deferred discretionary replacement activities. This and the continuation of economic uncertainty and elevated interest rates weighed heavily on new pool starts. While the decrease in new pool construction presents challenges across multiple facets of operations, there is confidence that the downturn mirrors the cyclicality observed historically. For 2024, the company expects new pool construction volumes to be flat to down 10%.

Pool has been witnessing increased expenses lately. Notably, inflationary cost increases in facilities, freight, insurance, IT, advertising and marketing are leading to higher expenses. During the first quarter, operating expenses (as a % of net sales) increased to 20.5% from 18.6% reported in the prior-year period. Rent and facility costs, inflationary wage increases, insurance costs, technology initiatives and investments in greenfield locations primarily drove the increase.

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has risen 47.9% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has risen 76.8% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

AMC Entertainment Holdings, Inc. AMC currently carries a Zacks Rank of 2 (Buy). AMC has a trailing four-quarter earnings surprise of 38%, on average. The stock has increased 37.2% in the past month.

The Zacks Consensus Estimate for AMC’s 2024 EPS implies growth of 70.5% from the year-ago level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Pool Corporation (POOL) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經