How is Qualcomm’s (QCOM) Growth Related to Nvidia?

ClearBridge Investments, an investment management company, released its “ClearBridge Small Cap Value Strategy” first quarter 2024 investor letter. A copy of the letter can be downloaded here. The firm focuses on companies with strong balance sheets and attractive cash flows with compelling valuations rather than following market trends. The strategy outperformed the benchmark Russell 2000 Value Index in the first quarter and generated gains across 11 sectors in which it was invested, on an absolute basis. Overall stock selection effects contributed to the performance on a relative basis. In addition, please check the fund’s top five holdings to know its best picks in 2024.

ClearBridge Small Cap Value Strategy highlighted stocks like QUALCOMM Incorporated (NASDAQ:QCOM), in the first quarter 2024 investor letter. QUALCOMM Incorporated (NASDAQ:QCOM) develops and commercializes foundational technologies for the wireless industry. The one-month return of QUALCOMM Incorporated (NASDAQ:QCOM) was 13.06%, and its shares gained 89.53% of their value over the last 52 weeks. On June 18, 2024, QUALCOMM Incorporated (NASDAQ:QCOM) stock closed at $227.09 per share with a market capitalization of $253.432 billion.

ClearBridge Small Cap Value Strategy stated the following regarding QUALCOMM Incorporated (NASDAQ:QCOM) in its first quarter 2024 investor letter:

"Another theme of that era was mobile telephony. QUALCOMM Incorporated (NASDAQ:QCOM) soared over 2,600% in 1999 on a very similar premise as Nvidia is seeing now — it was the brains behind the secular trend, so whoever won, Qualcomm would participate. The theme was spot on, the company was perfectly positioned, and it went on to perform massively well. From 1999 to 2023, Qualcomm’s sales rose more than 9x and EBITDA 12x, very impressive long-term growth rates. Investors who held the stock during that period, however, received a total return of only 154%, underperforming the 410% return of the S&P 500 Index."

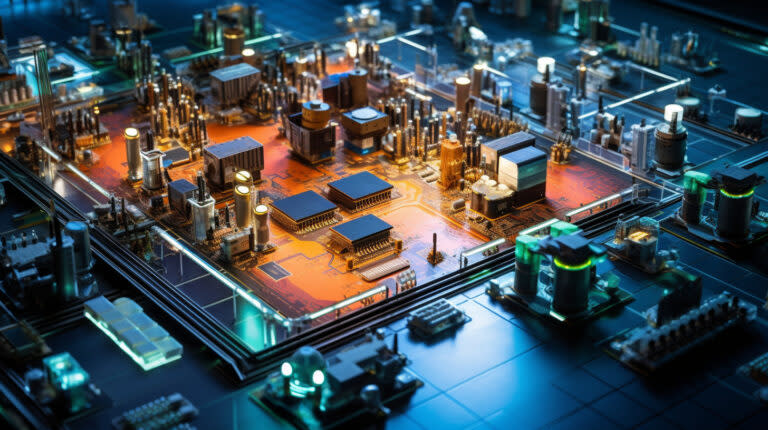

An aerial view of a bustling semiconductor production zone showcasing the company’s integrated circuits.

QUALCOMM Incorporated (NASDAQ:QCOM) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 78 hedge fund portfolios held QUALCOMM Incorporated (NASDAQ:QCOM) at the end of the first quarter which was 78 in the previous quarter. While we acknowledge the potential of QUALCOMM Incorporated (NASDAQ:QCOM) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed QUALCOMM Incorporated (NASDAQ:QCOM) and shared the list of best AI PC stocks to buy. Also, QUALCOMM Incorporated (NASDAQ:QCOM) is one of the best hardware stocks according to Goldman Sachs. In addition, please check out our hedge fund investor letters Q1 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.

雅虎香港財經

雅虎香港財經