Reasons to Add Veeva Systems (VEEV) Stock to Your Portfolio

Veeva Systems Inc. VEEV is well-poised for growth in the coming quarters, courtesy of its strong product portfolio. The optimism, led by a solid fourth-quarter fiscal 2024 performance and strategic deals, is expected to contribute further. Stiff competition and data security threats persist.

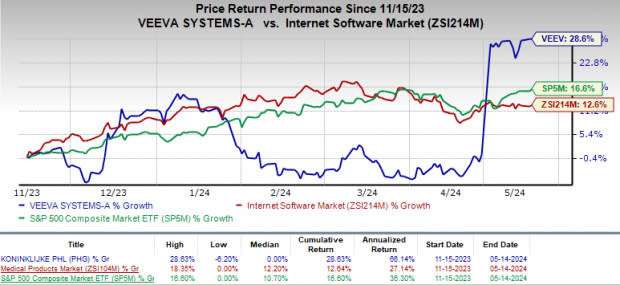

Over the past six months, this current Zacks Rank #2 (Buy) stock has gained 28.6% compared with 12.6% growth of the industry and a 16.6% rise of the S&P 500 Composite.

The renowned provider of cloud-based software applications and data solutions for the life sciences industry has a market capitalization of $32.9 billion. The company projects 24.1% growth for the next five years and expects to maintain its strong performance going forward. It delivered an average earnings surprise of 8.5% in the past four quarters.

Image Source: Zacks Investment Research

Let us delve deeper.

Strong Product Portfolio: We are optimistic about Veeva Systems’ unique solutions, which include Veeva Vault, Veeva CRM (customer relationship management), Veeva Network and Veeva OpenData.

On the fiscal fourth quarter of 2024 earnings call, Veeva Systems’ management discussed the progress of adding Marketing Automation and Patient CRM to the Commercial Cloud and the expansion of the Data Cloud to clinical.

In April 2024, Veeva Systems announced that the Veeva AI Partner Program is likely to provide partners with the cutting-edge tools and assistance required to smoothly combine Generative AI (GenAI) solutions with Veeva Vault applications. The Veeva AI Partner Program includes Vault Direct Data API training and support to build expertise in leveraging Veeva Vault Platform's unique, high-speed API.

The company also announced Veeva Vault CRM Campaign Manager, a new industry-specific marketing application that simplifies and speeds non-personal promotion to healthcare professionals.

Strategic Deals: We are upbeat about Veeva Systems’ inking of a slew of notable deals. In February, the company announced that Boehringer Ingelheim, a global animal health leader, has chosen Veeva Vault Clinical and Veeva Vault RIM applications as the technology foundation for the clinical and regulatory management of its health business unit.

Veeva Systems declared in January that SK Biopharmaceuticals Co. Ltd.’s subsidiary, SK Life Science, Inc., is expediting and streamlining its validation process with Veeva Vault Validation Management.

Strong Q4 Results: Veeva Systems’ solid fourth-quarter fiscal 2024 results buoy optimism. Throughout the quarter, the company’s top and bottom lines improved. Both of its segments registered strong results. It kept reaping the rewards of its flagship Vault platform.

Strong win rates in Veeva CRM and new customer acquisitions demonstrated Veeva Systems' ongoing strength in its Commercial Solutions were also evident.

Downsides

Data Security Threats: Veeva Systems provides systems that store and transfer sensitive data, including patient and clinical trial participant personal information, proprietary information belonging to its customers, and information from other sources. Improper entry or additional security lapses or events may harm the business's structure. It is likely that VEEV will not be able to anticipate security threats or implement adequate defenses. This is partially due to the fact that techniques for breaching systems or gaining access to accounts are always changing and becoming more complex and sophisticated.

Stiff Competition: Veeva Systems competes fiercely in its industry. In new sales cycles within its largest product categories, the company confronts competition from vendors offering alternative cloud-based solutions with applications for the health sciences industry. Veeva Systems' Commercial Cloud and Veeva Vault application suites pose a challenge to the client-server-based legacy solutions provided by several smaller application providers and large corporations.

Estimate Trend

VEEV is witnessing a positive estimate revision trend for earnings in fiscal 2025. In the past 60 days, the Zacks Consensus Estimate for its earnings has moved 0.9% north to $6.14 per share.

The Zacks Consensus Estimate for the company’s first-quarter fiscal 2025 revenues is pegged at $641.7 million, indicating a 21.92% improvement from the year-ago quarter’s reported number.

Veeva Systems Inc. Price

Veeva Systems Inc. price | Veeva Systems Inc. Quote

Other Key Picks

Some other top-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2, reported first-quarter 2024 adjusted earnings per share (EPS) of $2.14, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經