Reasons to Hold FTI Consulting (FCN) Stock in Your Portfolio

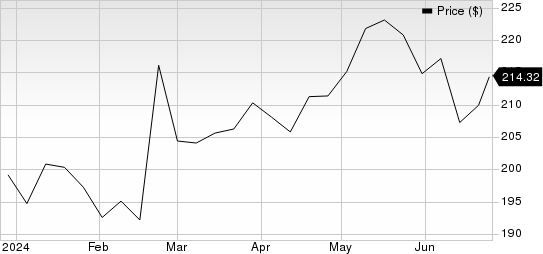

FTI Consulting, Inc.’s FCN price trend reveals that the stock has had an impressive run in the past six months. Shares of FCN have returned 7.5% against the 8.6% decline of the industry it belongs to.

Factors that Augur Well

FCN’s international operations help expand its geographic footprint and contribute to top-line growth. In 2023, the company earned almost 37% of its revenues from its international businesses. The industrial and geographical diversification of its customer base (throughout the United States and internationally) helps mitigate the risk of incurring material losses.

FTI Consulting, Inc. Price

FTI Consulting, Inc. price | FTI Consulting, Inc. Quote

FCN consistently rewards shareholders through share buybacks. In 2023, 2022, and 2021, the company had repurchased shares worth $21 million, $85.4 million, and $46.1 million, respectively. These initiatives instill investor confidence and positively impact earnings per share.

FTI Consulting's current ratio (a measure of liquidity) stood at 2.46 at the end of the first quarter of 2024, higher than 1.74 at the end of the preceding quarter. A current ratio of more than 1 indicates that the company will easily pay off its short-term obligations.

FTI Consulting has an impressive earnings surprise history. The company outpaced the consensus mark in all the trailing four quarters, delivering an average beat of 27.8%. The Zacks Consensus Estimate of $8.22 for FCN’s 2024 earnings indicates year-over-year growth of 6.6%. Earnings are expected to register 12.3% growth in 2025.

A Risk

FTI Consulting makes most of its investments in hiring highly qualified professionals and promoting and training individuals. Such investments are necessary to enhance growth and will likely benefit the company in the long term. However, escalating investments in people are likely to increase the costs incurred by FCN and dent bottom-line growth in the initial stages.

Zacks Rank and Stocks to Consider

FTI Consulting currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Barrett Business Services BBSI and Charles River Associates CRAI

Barrett Business Services carries a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BBSIhas a long-term earnings growth expectation of 14%. It delivered a trailing four-quarter earnings surprise of 38.6%, on average.

Charles River Associates currently carries a Zacks Rank of 2. It has a long-term earnings growth expectation of 16%. CRAI delivered a trailing four-quarter earnings surprise of 19.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經