Semrush (SEMR) Boosts Digital Marketing With Datos Integration

Semrush Holdings, Inc. SEMR has enhanced its digital marketing capabilities by integrating global clickstream data from Datos, which it acquired in December 2023. The move aims to improve the digital marketing workflow for Semrush's diverse clientele, including individual marketers, SMBs and large enterprises.

Datos’ integration significantly enhances Semrush's portfolio of competitive intelligence products and the new Enterprise SEO platform. The Enterprise SEO platform harnesses an extensive database of more than 25.7 billion keywords and 43 trillion backlinks, providing users with unparalleled insights and competitive advantages.

The platform's AI-powered tools offer real-time content optimization, helping marketers enhance content across multiple languages efficiently. Additionally, it includes sophisticated A/B testing and forecasting features that empower data-driven decision-making, ensuring maximum value and revenue generation.

By leveraging Datos' advanced analytics solutions and comprehensive domain traffic products, Semrush customers can now gain deeper insights into consumer behavior, market trends and competitive landscapes on a global scale. It helps to uncover market trends and provide key intelligence as it transforms data into unique, accurate and actionable insights, benefiting customers immensely.

The enhanced data analytics capabilities empower users to better understand the consumer journey and the path to purchase. This comprehensive understanding allows businesses to refine their marketing strategies, optimize their campaigns and ultimately, achieve better results in their digital marketing efforts. Moreover, the integration ensures that Semrush remains at the forefront of providing cutting-edge competitive intelligence, enabling businesses of all sizes to stay ahead of their competition. This, in turn, positions Semrush as a leading player in online visibility management.

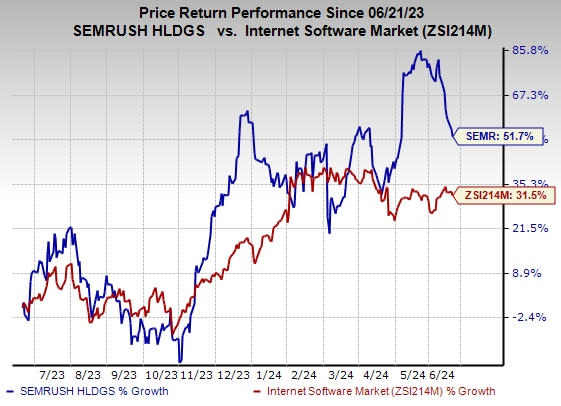

The stock has gained 51.7% in the past year compared with the industry’s growth of 31.5%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Semrush currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Harmonic Inc. HLIT, currently carrying a Zacks Rank #2 (Buy), is another key pick in the broader industry. Headquartered in San Jose, CA, the company provides video delivery software, products, system solutions and services worldwide.

With more than three decades of experience, HLIT has revolutionized cable access networking via the industry's first virtualized cable access solution, enabling cable operators to more flexibly deploy gigabit Internet service to consumers' homes and mobile devices. Harmonic delivered an earnings surprise of 5.6%, on average, in the trailing four quarters.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 at present, delivered an earnings surprise of 7.5%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 9.5%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products, and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Harmonic Inc. (HLIT) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

SEMrush Holdings, Inc. (SEMR) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經