Smurfit Kappa (SMFKY) to Acquire Bulgarian Bag-in-Box Plant

Smurfit Kappa SMFKY recently announced that it has inked a deal to acquire Artemis Ltd., a Bag-in-Box packaging plant located in Shumen, Bulgaria. This move will strengthen SMFKY’s presence and customer base in Europe, enhance its product portfolio and add to its innovation capabilities in the promising Bag-in-Box sector.

Artemis has been manufacturing Bag-in-Box packaging for liquid food products for more than a decade. It also makes caps for wine and alcoholic drinks.

Smurfit Kappa is one of the few providers offering comprehensive Bag-in-Box and Pouch-Up packaging systems. Bag-in-Box is a sustainable choice of packaging for many industries, such as wine and other liquid food items, dairy as well as non-food applications, such as motor oil and chemicals. One of the main advantages of Bag-in-Box packaging is that it helps to significantly extend the shelf life of liquid products, thus minimizing wastage.

The company’s Vitop Original tap is the preferred closure solution choice for Bag-in-Box wines and juices due to its quality and reliability, with global sales of more than 6 billion. In 2023, Smurfit Kappa patented an innovative Vitop Uno tap, which is the first tap in the Bag-in-Box market to have attached tamper protection.

The company remains focused on growing its Bag-in-Box division and has embarked on a multi-country expansion plan.

In February 2024, Smurfit Kappa had announced a €54 million (around $59 million) investment in its Ibi Bag-in-Box plant in Alicante, Spain. Bag-in-Box Ibi creates a broad range of products for wine, dairy products, liquid eggs, cooking oils and water. This investment is expected to double the plant’s capacity and strengthen the sustainability of both the plant’s operations and Smurfit Kappa’s product portfolio, with enhanced waste management systems and significant savings in energy consumption.

Smurfit Kappa’s pending merger with WestRock WRK is expected to close in July 2024. It will create one of the world’s largest paper and packaging companies worth around $20 billion. Smurfit WestRock will have an unmatched geographic reach spanning 42 countries. With the two companies’ highly complementary portfolios and innovative sustainability capabilities, as well as the massive geographic reach, the merged entity is likely to be the preferred packaging partner for companies and customers across the globe.

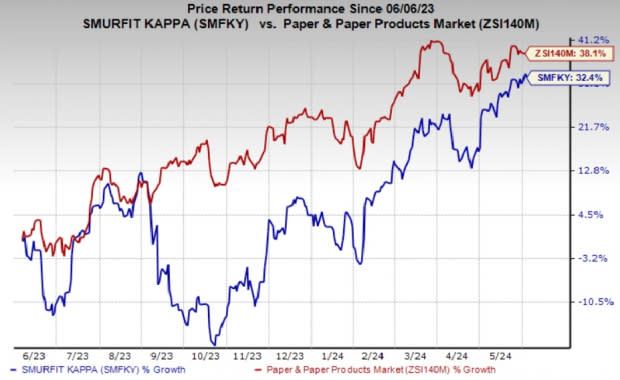

Price Performance

Smurfit Kappa’s shares have gained 32.4% over the past year compared with the industry’s 38.1% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Smurfit Kappa currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS and ATI Inc. ATI. CRS sports a Zacks Rank of 1 (Strong Buy) at present and ATI carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.18 per share. The consensus estimate for earnings has moved 6% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 15.1%. CRS shares have gained 108% in a year.

The Zacks Consensus Estimate for ATI’s 2024 earnings is pegged at $2.41 per share. The consensus estimate for ATI’s current-year earnings has been revised 3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 8.3%. The company’s shares have rallied 65.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report

Smurfit Kappa (SMFKY) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經