Synchrony (SYF) & IME to Enhance Home Improvement Solutions

Synchrony Financial SYF recently established a partnership with an enterprise software and services company, Installation Made Easy (“IME”), which supports retail-based home improvement programs. The partnership aims to simplify the financing process for homeowners undertaking kitchen, bath, and flooring installations.

This partnership is expected to enable homeowners to buy Floor & Decor materials and instantly arrange installation services via IME. Floor & Decor cardholders can utilize their Synchrony-issued credit cards to finance the materials and the installation process. This will enable them to spread the cost of their total project over time.

Synchrony strategically pursues partnerships to bolster its business and enhance digital capabilities and diversification. The number of its partners is continually increasing, with more than 60 partners being added or relationships being renewed in 2023.

The latest partnership is expected to enhance SYF’s financing capabilities throughout the home improvement space. The company aims to gradually extend the partnership to encompass more retailers in the future. The move is likely to boost period-end loan receivables in its Home & Auto sales platform. The metric jumped 11.9%, 6.6% and 9.7% in 2022, 2023 and the first quarter of 2024, respectively.

The Zacks Consensus Estimate for Home & Auto period-end loan receivables for 2024 predicts a more than 9% year-over-year growth. Also, the consensus mark for the 2024 Home & Auto average active account indicates a 2.5% increase from the 2023 level. As such, the consensus estimate for interest and fees on loans for this year signals a 4.5% rise from the year-ago level.

Price Performance

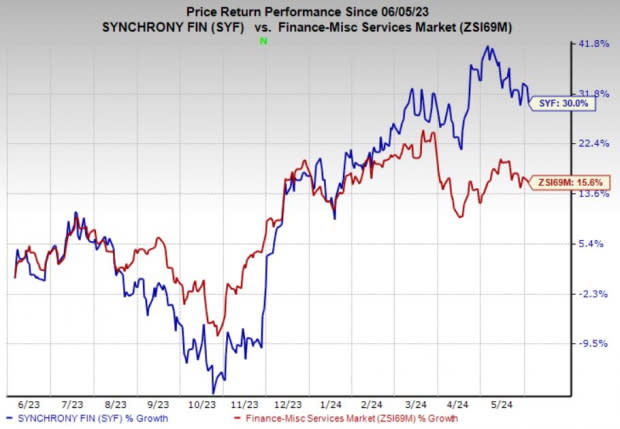

Shares of Synchrony Financial have gained 30% in the past year compared with the industry’s 15.6% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Synchrony Financial currently carries a Zacks Rank #3 (Hold). Investors interested in the broader Finance space may look at some better-ranked players like Jackson Financial Inc. JXN, Euronet Worldwide, Inc. EEFT and CleanSpark, Inc. CLSK, each carrying a Zacks Rank #2 (Buy) now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Jackson Financial’s current-year earnings indicates 32.2% year-over-year growth. JXN beat earnings estimates twice in the past four quarters and missed on the other occasions. The consensus mark for current year revenues predicts a 115.1% jump from a year ago.

The Zacks Consensus Estimate for Euronet Worldwide’s 2024 earnings indicates 15.8% year-over-year growth. During the past two months, EEFT has witnessed three upward estimate revisions against none in the opposite direction. It beat earnings estimates in each of the past four quarters, with an average surprise of 9.3%.

The Zacks Consensus Estimate for CleanSpark’s current-year earnings suggests a 140.3% year-over-year improvement. During the past month, CLSK has witnessed one upward estimate revision against none in the opposite direction. The consensus mark for current year revenues suggests a 183.6% surge from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

Cleanspark, Inc. (CLSK) : Free Stock Analysis Report

Jackson Financial Inc. (JXN) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經