Synovus Financial Corp (SNV) Q1 2024 Earnings Analysis: Challenges Amidst Strategic Progress

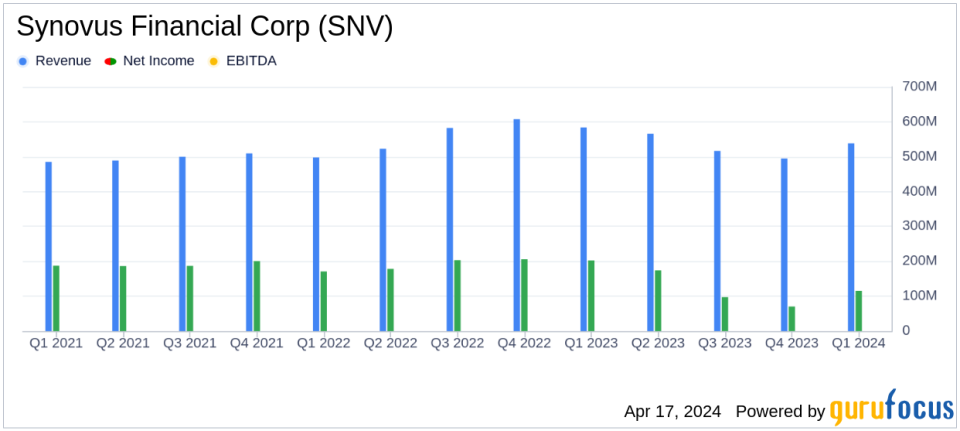

Earnings Per Share (EPS): Reported EPS of $0.78, falling short of the estimated $0.99.

Net Income: Achieved $114.8 million, significantly below the estimated $149.60 million.

Revenue: Posted $537.73 million, slightly below the estimated $547.63 million.

Net Interest Margin: Recorded at 3.04%, indicating a compression from previous quarters.

Loan and Deposit Dynamics: Total loans decreased by 1.7% year-over-year, while deposits showed a modest increase of 1.3%.

Synovus Financial Corp (NYSE:SNV) released its 8-K filing on April 17, 2024, detailing its financial performance for the first quarter of the year. The results show a mix of strategic progress amidst certain financial challenges. Synovus, a prominent financial services entity headquartered in Columbus, Georgia, operates through its subsidiary, Synovus Bank, and various offices across the Southeastern U.S., delivering a comprehensive range of banking and financial services.

Financial Performance Overview

The first quarter saw Synovus reporting a net income available to common shareholders of $114.8 million, or $0.78 per diluted share, a stark contrast to $193.9 million, or $1.32 per diluted share, in the same quarter of the previous year. This decline was influenced by a $12.8 million FDIC Special Assessment, which trimmed the EPS by $0.07. When adjusted for this assessment, the EPS slightly improves to $0.79.

Net interest income for the quarter was reported at $418.8 million, down 13% from the first quarter of 2023, primarily due to a decrease in average earnings assets and heightened funding costs. Despite these challenges, Synovus exhibited robust control over operating expenses and marked an increase in core commercial lending.

Strategic and Operational Highlights

CEO Kevin Blair highlighted the strategic advancements, noting significant growth in commercial category loans and core deposits, alongside an enhancement in client non-interest revenue. The bank has also seen improvements in its risk profile, with the highest common equity tier 1 capital ratios observed in several years, and a 30% reduction in wholesale funding compared to the previous year.

Asset and Liability Management

On the assets front, total loans ended the quarter slightly lower at $43.3 billion, impacted by soft loan demand and higher paydowns. However, commercial and industrial loans saw a marginal increase. The deposit portfolio grew modestly to $50.6 billion, driven by growth in time deposits, though offset by reductions in non-interest-bearing deposits.

Market and Future Outlook

The financial landscape for Synovus shows a blend of opportunities and challenges. The bank's strategic initiatives are setting a foundation for resilience and growth, particularly in its commercial lending and deposit gathering activities. However, the external economic pressures and rising funding costs pose ongoing challenges that could impact future profitability and operational efficiency.

Synovus remains committed to its growth trajectory and operational optimization as it navigates through the evolving economic conditions. Investors and stakeholders will likely keep a close watch on how the bank manages its interest income streams and cost of capital in upcoming quarters.

For detailed financial figures and future projections, stakeholders are encouraged to view the full earnings report and tune into the upcoming earnings conference call scheduled for April 18, 2024.

Explore the complete 8-K earnings release (here) from Synovus Financial Corp for further details.

This article first appeared on GuruFocus.

雅虎香港財經

雅虎香港財經