TEVA Stock Rises 135% in a Year: What's Driving the Recovery?

Teva Pharmaceutical Industries Limited’s TEVA revenues have suffered significantly since it lost exclusivity of key multiple sclerosis medicine, Copaxone, in 2015. Teva also faces competitive pressure for some of its key branded drugs. The orphan drug exclusivity attached to bendamustine products (Bendeka and Treanda) expired in December 2022. Several generic versions of Treanda have been launched. Teva saw limited new complex generic approvals in the last 2-3 years from the FDA. Teva also has a high debt load and faces some price-fixing charges.

However, Teva expects its newer drugs, Austedo, Uzedy and Ajovy, as well as a stable generics business, to help revive top-line growth in future quarters.

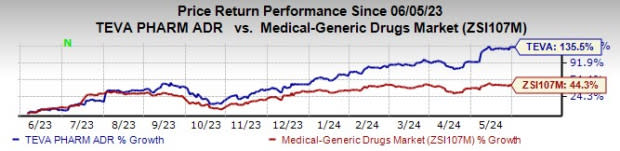

In the past year, shares of Teva have risen 135.3% compared with the industry’s growth of 44.3%. Here, we discuss the factors that have led to the improvement in Teva’s stock price after years of remaining suppressed.

Image Source: Zacks Investment Research

Teva's two newest drugs, Austedo and Ajovy, are seeing continued market share growth. Sales of Ajovy and Austedo grew 18% and 28%, respectively, in 2023. Though Teva is seeing slower growth of Ajovy in the U.S. market, it expects sales to benefit from continued patient growth and launches in additional countries in Europe and international markets.

For Austedo, Teva expects to achieve annual revenues of more than $2.5 billion by 2027. The Austedo franchise got a boost from the launch of Austedo XR, a new once-daily formulation launched in May 2023. Teva expects to launch Austedo in European markets in 2026. Teva expects Ajovy and Austedo revenues of approximately $500 million and $1.5 billion, respectively, in 2024.

Uzedy (risperidone) extended-release injectable suspension, a long-acting subcutaneous atypical antipsychotic injection for the treatment of schizophrenia in adults, was launched in May 2023 in the United States. Uzedy has shown up to 80% reduction in the risk of schizophrenia relapse versus placebo in a phase III study. In 2024, Teva expects Uzedy sales of approximately $80 million.

Teva markets biosimilar versions of Roche’s cancer drugs Rituxan (Truxima) and Herceptin (Herzuma). Teva launched the first biosimilar version of Bristol-Myers Revlimid in the United States in March 2022, which has been improving its generic revenues. Teva has a decent pipeline of biosimilars, with some being developed in partnership with Alvotech ALVO. A biosimilar version of AbbVie’s blockbuster immunology medicine, Humira, called Simlandi, was approved in February 2024 and launched in May.

Selarsdi, a biosimilar version of J&J’s JNJ Stelara, was approved in April 2024 and per a settlement with J&J, Teva will launch the biosimilar in February 2025. Ranivisio (ranibizumab), a biosimilar to Roche’s Lucentis, was granted marketing authorization in Europe in August 2022. Biosimilars of Prolia, Eylea, Simponi, Xgeva and Xolair are in late-stage development. Teva expects to launch six biosimilars by 2027. Teva also expects to launch 13 complex generic products between 2024 and 2025.

Teva has also made decent progress with its branded pipeline. In May, it announced positive data from a phase III study called SOLARIS on its key pipeline candidate, olanzapine, a long-acting subcutaneous injectable (LAI) for treating schizophrenia. The study met its primary and secondary endpoints in all dose groups versus placebo. At present, there is no effective long-term treatment for schizophrenia, resulting in a significant unmet medical need. Teva has also signed a funding agreement with Royalty Pharma to accelerate the development of olanzapine LAI.

Another important pipeline candidate is TEV-48574, its anti-TL1A therapy in mid-stage development for inflammatory bowel diseases (“IBD”), ulcerative colitis and Crohn’s disease. Teva has partnered with Sanofi SNY for its TEV-4857 to maximize the value of the asset. Teva and Sanofi will equally share the development costs globally.

Teva faced several lawsuits from cities, states and Native American tribes, which claimed that it was one of the several companies whose opioid-based drugs were responsible for fueling the nationwide opioid epidemic.

In June 2023, Teva fully resolved its nationwide settlement agreement related to opioid claims brought by all 50 U.S. states and more than 99% of the litigating subdivisions and special districts. As part of the settlement, Teva will pay up to $4.25 billion (including the already settled cases), spread over 13 years, including deliveries of up to $1.2 billion of its generic version of Narcan.

With the nationwide settlement for the costly opioid litigations, new product launches, stability of the generics segment with contribution from biosimilars and a robust biosimilar and branded pipeline, the path for Teva’s long-term growth is becoming clearer. Teva is saving costs and improving margins through the optimization of operations for efficiency while also lowering the debt on its balance sheet. We believe all these factors should keep the stock afloat this year.

Zacks Rank

Teva currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

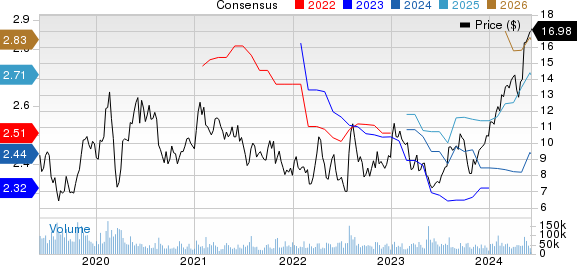

Teva Pharmaceutical Industries Ltd. Price and Consensus

Teva Pharmaceutical Industries Ltd. price-consensus-chart | Teva Pharmaceutical Industries Ltd. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Alvotech (ALVO) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經