Texas Instruments (TXN) Aids Portfolio With DRV7308 Power Module

Texas Instruments’ TXN shares have rallied 17.6% in the year-to-date period, outperforming the industry’s growth of 7%. The company is benefiting from a strong product portfolio, which is driving its momentum across various end markets.

Texas Instruments’ recent launch of the DRV7308 gallium nitride (GaN) intelligent power module (IPM) in order to strengthen its portfolio further, remains noteworthy.

The GaN IPM which is designed to aid the development of motor drive systems efficiently, offers over 99% inverter efficiency, optimized acoustic performance, reduced solution size and lower system costs.

Texas Instruments is expected to gain solid traction across heating, ventilation and air-conditioning (HVAC) applications as the latest GaN IPM takes care of many design and performance complications in these applications.

The latest move is also likely to add strength to the company’s Motor Drives business unit.

Moreover, DRV7308 will enable Texas Instruments to capitalize on growth opportunities present in the intelligent power module market, which, per a Mordor Intelligence report, is anticipated to hit $2.12 billion in 2024 and reach $3.63 billion by 2029, indicating a CAGR of 9.9% between 2024 and 2029.

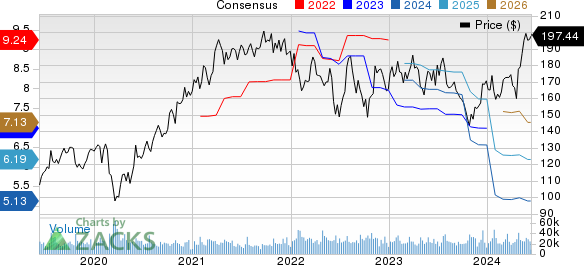

Texas Instruments Incorporated Price and Consensus

Texas Instruments Incorporated price-consensus-chart | Texas Instruments Incorporated Quote

Competitive Advantage

The GaN IPM launch has placed Texas Instruments at a competitive advantage over industry peers like ON Semiconductor ON, STMicroelectronics STM and Broadcom AVGO, which are also making strong efforts to strengthen their foothold in the global IPM market.

On a year-to-date basis, TXN has outperformed both onsemi and STMicroelectronics, which declined 11.4% and 12.5%, respectively.

ON Semiconductor recently launched its 7th generation insulated gate bipolar transistors (IGBT)-based IPM, the FS7 1200 V SPM31, aimed at improving efficiency and density in three-phase inverter drive applications, focusing on Field Stop IGBT technology.

STMicroelectronics, on the other hand, is benefiting from its small low loss intelligent molded module (SLLIMM) High Power series of compact, powerful IPMs, which offer enhanced capabilities in terms of breakdown voltage, current capability, power range and package options.

Meanwhile, Broadcom which has gained 31.4% year to date, offers IPM interface optocouplers, providing short propagation delay, fast IGBT switching, high common mode transient rejection, and wide operating temperature range.

Expanding Portfolio Aids Prospects

Texas Instruments’ growing efforts to expand its product portfolio include the launch of two new power conversion device portfolios, focusing on achieving higher power density in smaller spaces and providing the highest power density at a lower cost. These products feature 100V integrated gallium nitride power stages and 1.5W isolated DC/DC modules.

The company also unveiled new semiconductors, namely the AWR2544 77GHz radar sensor chip and software-programmable driver chips, DRV3946-Q1 and DRV3901-Q1, to enhance automotive safety and intelligence by offering improved sensor fusion and decision-making in ADAS.

Texas Instruments expanded its low-power GaN portfolio to improve power density and system efficiency and reduce system size. The new portfolio, including LMG3622, LMG3624, and LMG3626, offers the industry's most accurate integrated current sensing, eliminating the need for an external shunt resistor and reducing power losses by up to 94%.

Strength in the company’s overall portfolio offerings will likely aid its top-line performance in the upcoming period.

Conclusion

Texas Instruments is well-poised to benefit from growing investments in new growth avenues and competitive advantages, along with a deepening focus on manufacturing, advanced technology infusion and product portfolio expansion.

However, the company is facing widespread weakness across the end-markets which is a major negative. Increasing manufacturing costs across its Analog, Embedded Processing and Other segments are expected to hurt its top-line growth.

The Zacks Consensus Estimate for 2024 total revenues stands at $15.74 billion, indicating a year-over-year fall of 10.2%.

The Zacks Consensus Estimate for TXN’s 2024 earnings is pegged at $5.13 per share, indicating a 27.4% decline from the year-ago reported figure. The figure has gone south by 0.8% in the past 30 days.

Moreover, TXN has a Value Score of F that reflects stretched valuation at the current level.

Investors should wait for a better entry point for Texas Instruments, which currently has a Zacks Rank #3 (Hold), given the modest growth prospect in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經