TopBuild (BLD) Expands Its Portfolio of Spray Foam Capabilities

TopBuild Corp. BLD acquired Texas Insulation from Energy One America, expanding its reach and product offering in Dallas, Houston, and Austin.

Texas Insulation installs spray foam and fiberglass insulation for customers in the residential and light commercial end markets. The acquired company will expand BLD’s spray foam capabilities in an important and growing geography.

Acquisitions are an important part of TopBuild’s growth strategy to supplement organic growth and expand access to additional markets and products. On May 3, TopBuild entered into an agreement to acquire the residential insulation business — Insulation Works, Inc. BLD is expected to acquire GreenSpace Insulation under the installation segment.

On Mar 1, TopBuild acquired the residential insulation business Morris Black and the customized insulation products and accessories business Pest Control Insulation or PCI. Morris Black is included under its installation segment, which expanded the company’s presence in the Pennsylvania market, while PCI is included under the specialty distribution segment. On Feb 15, the company acquired the assets of the residential and light commercial insulation business, Brabble. This installation segment acquisition enhanced its presence in North Carolina.

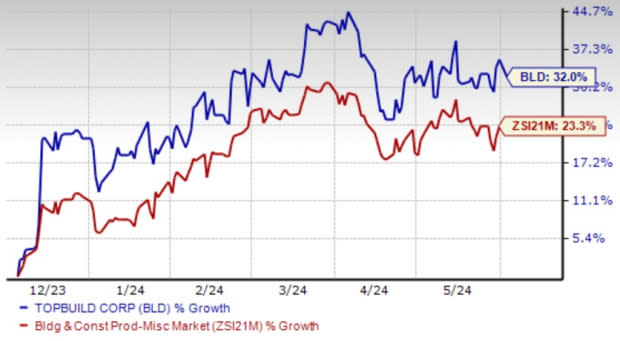

Price Performance

In the past six-month period, this installer and distributor of insulation and other building products shares have outperformed in the Zacks Building Products - Miscellaneous industry. Its stock gained 32% compared with the industry’s growth of 23.3%.

Image Source: Zacks Investment Research

Earnings estimate for 2024 moved north to $21.50 per share from $21.02 in the past 30 days, reflecting analysts’ optimism for its growth potential. The estimated figure reflects 9% year-over-year growth.

TopBuild has been experiencing increased profitability, depicting a flexible operating model and its ability to quickly reduce costs. This was backed by its focus on productivity initiatives and expansion in its multi-family and commercial business, along with single-family construction. As a prominent player in both insulation installation and specialty distribution, TopBuild is positioned to effectively cater to a wide range of customers.

Zacks Rank & Key Picks

Currently, TopBuild carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are:

Frontdoor, Inc. FTDR: Based in Memphis, TN, the company provides home service plans in the United States. The firm is benefiting from impressive customer retention rates. Thanks to the robust awareness of the Frontdoor brand, it has been shifting its attention toward capitalizing on customer demand.

Frontdoor’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 286.8%. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Armstrong World Industries, Inc. AWI: Pennsylvania-based Armstrong World is a leading global producer of ceiling systems for use primarily in the construction and renovation of commercial, institutional and residential buildings. Currently, it flaunts a Zacks Rank of 1.

AWI has a solid earnings surprise history. Its bottom line surpassed the consensus estimate in the trailing four quarters, with an average of 15.2%.

Owens Corning OC: This building materials systems and composite solutions provider has evolved as a market-leading innovator of glass fiber technology. Moreover, its focus on new product and process innovation, along with inorganic moves, bode well.

OC’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 17.4%. It currently sports a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Frontdoor Inc. (FTDR) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經