Zions Bancorp (ZION) Rides on Loans & Deposits Amid High Costs

Zions Bancorporation ZION remains well-positioned for revenue growth on the back of strong loans and deposits, fee-income expansionary efforts, high rates and asset yield repricing. However, an elevated expense base and poor asset quality remain concerns.

Zions’ organic growth strategy is demonstrated through its revenue growth trajectory. The company’s total revenues witnessed a 2.3% compound annual growth rate (CAGR) over the last five years ended in 2023. The growth was primarily driven by robust loan growth, with loans and leases (net of unearned income and fees) experiencing a CAGR of 4.4% over the last four years ended in 2023.

ZION’s efforts to enhance fee income, decent loan demand and higher interest rates are likely to aid top-line expansion. Given the tough operating backdrop, we project total revenues (FTE) to fall 3.9% in 2024, while rebound and grow at the rate of 4.4% and 4.9% in 2025 and 2026, respectively. Further, we estimate total loans to witness a 2.3% CAGR by 2026.

Amid the high interest rate environment, Zions’ net interest margin (NIM) is expected to witness modest growth, while high funding costs will weigh on it to some degree. NIM increased to 3.06% in 2022 on account of a rise in interest rates. Though the metric declined in 2023 due to higher funding costs, we expect the same to be positively impacted in the near term driven by the current high rates and asset-yield repricing. We estimate NIM to be 3.02%, 3.22% and 3.37% in 2024, 2025 and 2026, respectively.

However, a persistent escalation in the expense base remains a challenge. While total non-interest expenses declined in 2020, the same witnessed a five-year CAGR of 4.5% for the year ended 2023. Given the ongoing investments in franchise and digital operations, the expense base is expected to remain elevated. Our estimates suggest adjusted non-interest expenses to witness a CAGR of 2.8% by 2026.

ZION’s deteriorating asset quality is another major headwind. Though the company recorded a provision benefit in 2021, a significant rise was recorded for the same in 2022 and 2023. The current tough macroeconomic outlook is anticipated to sustain the uptrend. While we estimate provision for credit losses to decline in 2024 and 2025, the metric will likely rise in 2026.

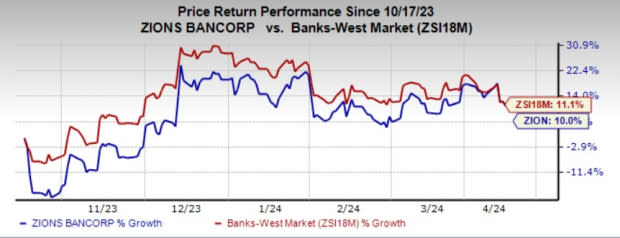

ZION currently carries a Zacks Rank #3 (Hold). Over the past six months, shares of the company have rallied 10%, underperforming the industry’s growth of 11.1%.

Image Source: Zacks Investment Research

Finance Stocks to Consider

Some better-ranked finance stocks worth mentioning are BlackRock Inc. BLK and Northern Trust Corporation NTRS.

BlackRock’s earnings estimates for the current year have been revised upward by 1.6% in the past seven days. The company’s shares have jumped 20% over the past six months. At present, BLK sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Estimates for Northern Trust’s earnings for the current year have been revised upward by 1.9% in the past week. The company’s shares have gained 18.6% over the past six months. At present, NTRS also sports a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經