AIG Reaches Key Milestone With Deconsolidation of Corebridge

American International Group, Inc. AIG has recently marked a major milestone with the deconsolidation of Corebridge Financial, Inc. CRBG for accounting purposes. It gave up majority control over Corebridge's board of directors, signified by the resignation of Chris Schaper, AIG's executive vice president and global chief underwriting officer, from Corebridge's board, which now has 12 members.

This action finalizes the long-awaited separation of the two companies. For several years, AIG meticulously planned and carried out the separation of Corebridge into an independent company. As a result, Corebridge has emerged as a leading annuity provider. This allows AIG to dedicate its focus to its core operations.

Following a successful IPO of CRBG in 2022, AIG continued lowering its stake in the company through a series of secondary offerings. This May, AIG launched a secondary offering of CRBG common stock, priced at $29.20 per share, and sold 30 million shares. It generated $872 million as net proceeds from the move. Currently, it owns around 48.35% of Corebridge's common stock.

Also, last month, AIG reached an agreement to divest around 120 million CRBG shares, which accounts for 20% of Corebridge's total shares, to Nippon Life Insurance Company. The shares were priced at $31.47 each, making the total transaction value $3.8 billion.

The deal with Nippon Life is likely to close in the first quarter of 2025. At the first-quarter 2024 end, Corebridge had more than $390 billion in assets under management and administration.

Price Performance

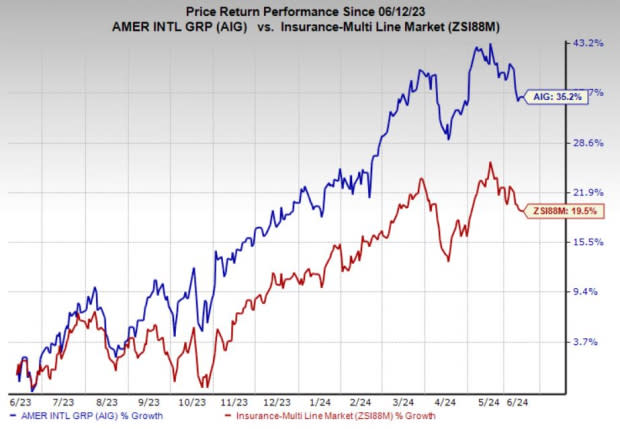

AIG shares have gained 35.2% in the past year compared with the 19.5% growth of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

AIG currently has a Zacks Rank #3 (Hold).

Investors interested in the broader Finance space may look at some better-ranked players like Brown & Brown, Inc. BRO and Root, Inc. ROOT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $3.61 per share, which indicates 28.5% year-over-year growth. It has witnessed one upward estimate revision against none in the opposite direction during the past month. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 11.9%.

The consensus mark for ROOT’s current-year earnings indicates a 53% year-over-year improvement. It beat earnings estimates in all the past four quarters, with an average surprise of 34.1%. Furthermore, the consensus estimate for Root’s 2024 revenues suggests 125.3% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report

Corebridge Financial, Inc. (CRBG) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經