Exploring Three Japanese Growth Companies With High Insider Ownership On The Tokyo Stock Exchange

As global markets experience varied performance with particular challenges in the U.S. and China, Japan's market presents a mixed landscape, influenced by recent economic data and central bank actions. Within this context, exploring growth companies with high insider ownership on the Tokyo Stock Exchange offers an intriguing opportunity for investors looking for entities potentially well-aligned with long-term strategic goals amid current market volatilities.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 27.2% |

Hottolink (TSE:3680) | 27% | 57.3% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 35.4% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 80.2% |

Money Forward (TSE:3994) | 21.4% | 63.5% |

Medley (TSE:4480) | 34% | 24.4% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 59.1% |

freee K.K (TSE:4478) | 24% | 82.7% |

Here's a peek at a few of the choices from the screener.

Japan Elevator Service HoldingsLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Elevator Service Holdings Co., Ltd. specializes in the repair, maintenance, and modernization of elevators and escalators across Japan, with a market capitalization of approximately ¥249.81 billion.

Operations: The company generates revenue primarily through its maintenance business, which accounted for ¥42.22 billion.

Insider Ownership: 23.4%

Japan Elevator Service Holdings Ltd. is demonstrating robust growth prospects, with earnings expected to grow by 18.2% annually, outpacing the broader Japanese market's 8.4%. This performance is supported by strategic expansions, including the recent opening of new service offices enhancing customer reach and services. Moreover, an increased dividend reflects strong fiscal health and a commitment to shareholder returns, underscoring the firm's potential in a competitive landscape despite not being the top player in its sector.

Mimaki Engineering

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mimaki Engineering Co., Ltd. is a global company that develops, manufactures, and sells computer devices and software, with a market capitalization of ¥48.66 billion.

Operations: Mimaki Engineering generates revenue primarily through sales in Japan/Asia/Oceania (¥62.31 billion), North/Latin America (¥21.49 billion), and Europe/Middle East/Africa (¥24.29 billion).

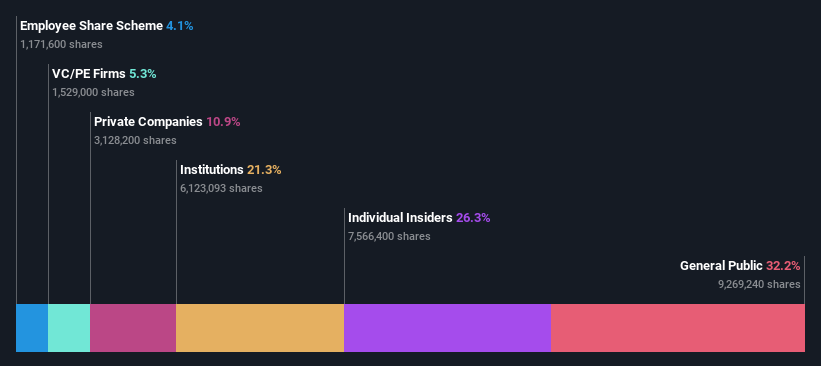

Insider Ownership: 26.3%

Mimaki Engineering is poised for significant growth, with earnings forecasted to increase by 20.23% annually, surpassing Japan's average. Despite a volatile share price and unstable dividend history, the company trades at 49.9% below its estimated fair value, suggesting potential undervaluation. Recent guidance indicates robust future performance with substantial increases in net sales and profits expected for FY2025, alongside a consistent dividend payout, reinforcing its appeal amidst high insider ownership dynamics.

Lasertec

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lasertec Corporation specializes in designing, manufacturing, and selling inspection and measurement equipment both in Japan and globally, with a market capitalization of approximately ¥3.93 trillion.

Operations: The company generates revenue primarily through the design, manufacture, and sale of inspection and measurement equipment on a global scale.

Insider Ownership: 12.1%

Lasertec, a Japanese growth company with high insider ownership, is expected to see substantial earnings growth of 20.71% annually, outpacing the market forecast of 8.4%. Despite recent executive changes enhancing leadership stability, its share price remains highly volatile. The company's revenue growth projection at 17% yearly also exceeds the market average significantly. With a forecasted Return on Equity of an impressive 40.7%, Lasertec demonstrates strong potential amidst some operational uncertainties.

Click here and access our complete growth analysis report to understand the dynamics of Lasertec.

Our valuation report here indicates Lasertec may be overvalued.

Next Steps

Access the full spectrum of 109 Fast Growing Japanese Companies With High Insider Ownership by clicking on this link.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:6544 TSE:6638 and TSE:6920.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

雅虎香港財經

雅虎香港財經