How to Find Great Under-the-Radar Stocks to Buy

The Nasdaq and the S&P 500 hit fresh highs to start a holiday-shortened trading week. The bulls continue to look ahead to impressive earnings growth and Fed rate cuts.

Despite the possibility of near-term pullbacks, the last several years highlight why investors must attempt to stay exposed to the market at all times. Those who want to buy stocks in June and the rest of the summer might consider searching for stocks gaining more attention from Wall Street.

The concept is simple: analysts are more inclined to start covering a stock that they view as having substantial upside potential vs. picking up coverage only to say ‘stay away.’

New Analyst Coverage

Broker recommendations play their part no matter how investors feel about them. And we seemingly all take a look no matter what. Individual investors, large institutional portfolio managers, and everyone in between are likely pleased to see one of their stocks get an upgraded rating or a new analyst cover the company.

Investor interest can generate more analyst coverage. This helps explain why analysts jump on young, much-hyped and talked about tech companies. Then, as new coverage is initiated, the company and the stock become more visible, which in turn often leads to more demand potential and therefore the possibility of higher prices.

Plus, analysts almost always initiate coverage with a positive recommendation. And the logic follows because why spend all the time and write a research report on a company not widely tracked only to say it’s not good?

When it comes to companies with little to no analyst coverage, one new recommendation can sometimes give portfolio managers the validation they need to build a position. And the more money they can invest, the more they can potentially influence prices.

The best way to use this information is to search for companies with analyst coverage that has increased over the last 4 weeks. We just look at the number of analyst recommendations today and compare it to the number of analyst recommendations 4 weeks ago.

The rule of thumb here is that an increase in coverage leans bullish and a decrease signals bearish behavior. It is also worth pointing out that, in general, the change in the average broker recommendation is a better indicator than the actual recommendation itself.

On top of that, it is typically more bullish if the increase went from none to one or if the coverage was minimal to begin with. (As the number of analysts climbs the addition of new coverage isn’t earth-shattering.) In the end, increased coverage is still better than decreased coverage, unless the coverage is heading in the wrong direction.

Now let’s try this screen…

• Number of Broker Ratings now greater than the Number of Broker Ratings four weeks ago

(This shows stocks where new coverage has recently been added.)

• Average Broker Rating less than Average Broker Rating four weeks ago

(By 'less than', we mean 'better than' four weeks ago.)

• Prices greater than or equal to 5

(We’re applying all of the above parameters to stocks above $5 a share since many money managers won't even look at stocks under $5)

• Average Daily Volume greater than or equal to 100,000 shares

(If there's not enough volume, even individual investors won't want it).

Here is one of the six stocks that came through the screen today…

GigaCloud Technology Inc (GCT) - (from 2 analysts four weeks ago to 3)

GigaCloud Technology Inc. operates a growing business-to-business marketplace to help connect suppliers and resellers from around the world. GigaCloud’s tech platforms enable discovery, payments, logistics solutions, messaging, and more to facilitate transactions with greater speed and efficiency.

The GigaCloud B2B Marketplace grew its gross merchandise value by 64% to $907.7 million in the 12 months ended March 31. Meanwhile, GCT posted 97% first quarter revenue growth to help boost its adjusted earnings by 71%.

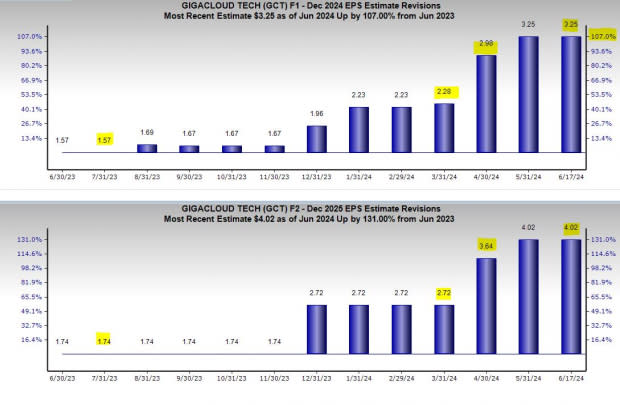

Image Source: Zacks Investment Research

GCT boosted its earnings outlook last quarter, and CEO Larry Wu said the company is confident that its “sustained growth will unlock even greater opportunities for our buyers and sellers, solidifying GigaCloud’s position at the forefront of streamlining the global supply chain for large parcel merchandise through our Supplier Fulfilled Retailing model.”

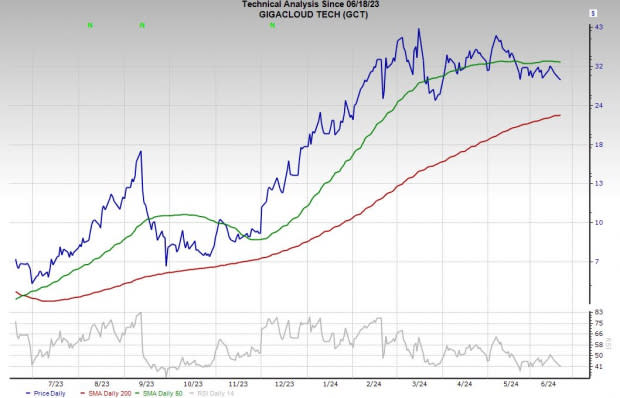

Image Source: Zacks Investment Research

GigaCloud is projected to grow its sales by 63% in 2024 and another 16% next year to reach $1.33 billion vs. $703.8 million in 2023. The company is projected to boost its adjusted earnings by 41% and 24%, respectively, after posting 280% adjusted EPS growth last year. GCT’s earnings outlook has skyrocketed over the last year, including since its Q1 release. GigaCloud’s FY24 consensus EPS has soared 107% in the last year, with its FY25 outlook 131% higher.

GigaCloud shares are up 270% in the past 12 months, yet they trade 50% below their average Zacks price target. GCT is attempting to find support below its 50-day moving average as it hovers near oversold RSI levels. GCT is also trading at a 71% discount to the tech sector and 55% below its year-long highs at 8.3X forward 12-month earnings.

Get the rest of the stocks on this list and start looking for the newest companies that fit these criteria. It's easy to do. And it could help you find your next big winner. Start screening for these companies today with a free trial to the Research Wizard. You can do it.

Click here to sign up for a free trial to the Research Wizard today.

Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: www.zacks.com/performance_disclosure

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GigaCloud Technology Inc. (GCT) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經