Here's Why Omnicom Group (OMC) Stock Is a Great Pick Now

Omnicom Group OMC is an advertising, marketing and corporate communications service provider that has performed extremely well over the past year and has the potential to sustain momentum in the near term. Consequently, if you have not taken advantage of the share price appreciation yet, it is time for you to add the stock to your portfolio.

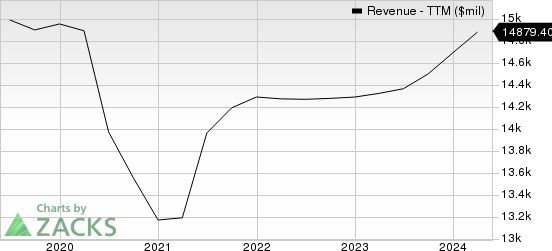

Omnicom Group Inc. Revenue (TTM)

Omnicom Group Inc. revenue-ttm | Omnicom Group Inc. Quote

What Makes OMC an Attractive Pick?

An Outperformer: The company stock has had an impressive run over the past six months. Shares of Omnicom have gained 19% compared with the 11.1% rally of the industry it belongs to and the 16.9% rise of the Zacks S&P 500 composite.

Northward Estimate Revisions: Four estimates for 2024 moved north in the past 60 days versus no southward revision, reflecting analysts’ confidence in the company. The Zacks Consensus Estimate for 2024 earnings has moved up 1.4% in the past 60 days.

Positive Earnings Surprise History: OMC has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in the trailing four quarters, delivering an earnings surprise of 3.2%, on average.

Strong Growth Prospects: The Zacks Consensus Estimate for OMC’s 2024 revenues is pegged at $15.6 billion, up 6.2% from the year-ago quarter. For 2025, the consensus estimate is pegged at $16.24 billion, indicating a year-over-year rise of 4.1%.

The consensus estimate for earnings for 2024 is pegged at $7.84 per share, up 5.8% on a year-over-year basis. For 2025, the consensus mark is pegged at $8.38 per share, implying 6.9% growth from the year-ago quarter’s actual.

Growth Factors: The top line of the company is being driven by advertising and media, and commerce and branding. The Global Media performance was responsible for growth in revenues across the advertising and media segment. The uptick in revenues across commerce and branding was backed by growth in specialty production. Omnicom has acquired Coffee & TV to leverage the scale of production operations and launch a holistic suite of global content and production services under a single unit.

Omnicom Group currently has a Zacks Rank of 2 (Buy).

Other Stocks to Consider

Some other top-ranked stocks in the broader Zacks Business Services sector are DocuSign DOCU and Barrett Business Services BBSI .

DocuSign currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

DOCU has a long-term earnings growth expectation of 13.3%. It delivered a trailing four-quarter earnings surprise of 23.7%, on average.

Barrett Business Services has a Zacks Rank of 2. It has a long-term earnings growth expectation of 14%.

BBSI delivered a trailing four-quarter earnings surprise of 38.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經