High Insider Ownership Growth Companies On SEHK In June 2024

As global markets exhibit mixed signals with regions like the U.S. and Europe showing varied economic data, the Hong Kong market has demonstrated resilience with a notable rise in the Hang Seng Index. This backdrop sets an intriguing stage for examining growth companies in Hong Kong, particularly those with high insider ownership, which can signal strong confidence in a company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 62.3% |

Fenbi (SEHK:2469) | 32.2% | 43% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73.8% |

Beijing Airdoc Technology (SEHK:2251) | 27.8% | 83.9% |

Let's dive into some prime choices out of from the screener.

LifeTech Scientific

Simply Wall St Growth Rating: ★★★★☆☆

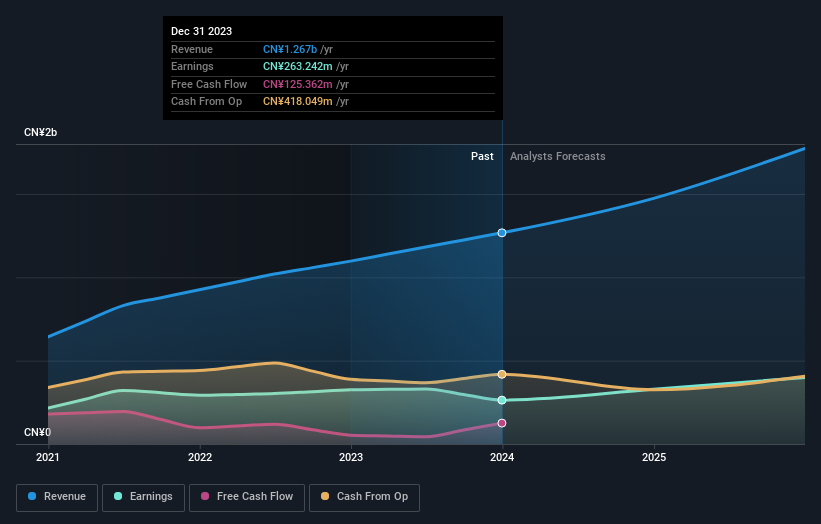

Overview: LifeTech Scientific Corporation, operating globally, focuses on developing, manufacturing, and trading interventional medical devices for cardiovascular and peripheral vascular diseases with a market capitalization of approximately HK$7.50 billion.

Operations: The company generates revenue primarily through three segments: Structural Heart Diseases Business (CN¥495.67 million), Peripheral Vascular Diseases Business (CN¥707.11 million), and Cardiac Pacing and Electrophysiology Business (CN¥64.40 million).

Insider Ownership: 17.4%

LifeTech Scientific, with high insider ownership, is positioned for growth in Hong Kong's competitive market. The company's revenue is forecast to grow at 16.8% annually, outpacing the Hong Kong market average of 7.8%. Despite this, its earnings growth projection of 20.55% per year also exceeds local norms. Recent product developments, like the successful Phase II trial of its IBS® Coronary Scaffold, underline its innovative edge and potential in medical technology. However, substantial insider selling over the past three months could raise concerns among potential investors about long-term confidence from those closest to the company.

SSY Group

Simply Wall St Growth Rating: ★★★★☆☆

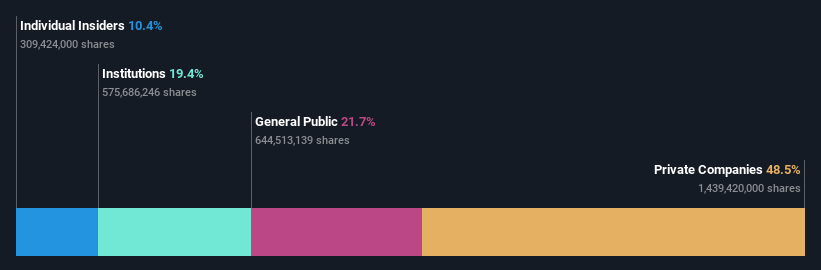

Overview: SSY Group Limited is an investment holding company that specializes in researching, developing, manufacturing, trading, and selling a range of pharmaceutical products primarily to hospitals and distributors within the People’s Republic of China and globally, with a market capitalization of approximately HK$14.22 billion.

Operations: SSY Group generates revenue primarily through two segments: Medical Materials, which brought in HK$0.39 billion, and Intravenous Infusion Solution and Others, contributing HK$6.30 billion.

Insider Ownership: 10.4%

SSY Group, a notable entity in Hong Kong's pharmaceutical sector, exhibits promising growth with its earnings and revenue expected to outpace the local market. Recent approvals from China's National Medical Products Administration for multiple drugs underscore its robust product pipeline and market expansion capabilities. However, the dividend coverage by cash flows remains weak, which might concern investors looking for sustainable income alongside growth. Insider transactions over the past three months show more buying than selling, reflecting confidence from those within the company.

Click here to discover the nuances of SSY Group with our detailed analytical future growth report.

The valuation report we've compiled suggests that SSY Group's current price could be quite moderate.

Value Partners Group

Simply Wall St Growth Rating: ★★★★☆☆

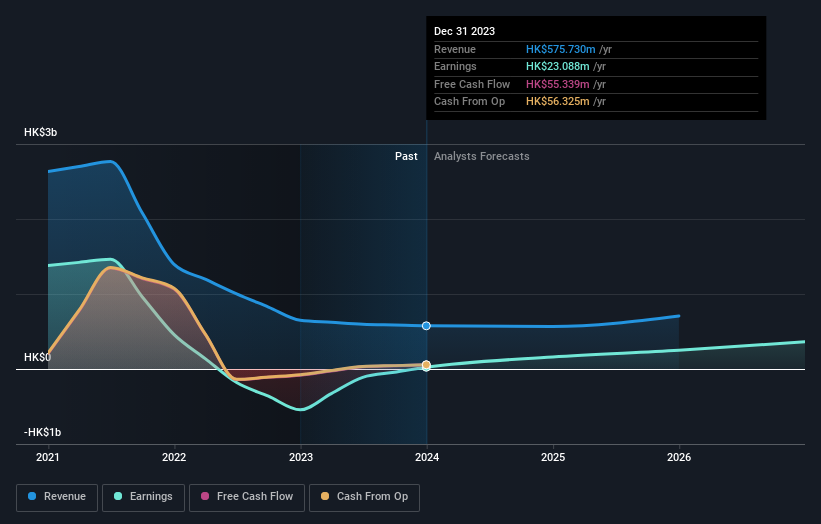

Overview: Value Partners Group Limited, a publicly owned investment manager, operates with a market capitalization of approximately HK$3.22 billion.

Operations: The firm generates its revenue primarily from its asset management business, which accounted for HK$575.73 million.

Insider Ownership: 23.7%

Value Partners Group, with a focus on growth and high insider ownership, has seen significant insider buying over the past three months, indicating strong confidence from its insiders. The company's earnings are expected to grow by 55.9% annually, outpacing the Hong Kong market significantly. However, it faces challenges with one-off items affecting financial results and a forecasted low return on equity of 8.8% in three years. Recent executive changes include the appointment of Mr. Till Rosar as an independent non-executive director, enhancing strategic expertise on the board.

Where To Now?

Click here to access our complete index of 53 Fast Growing SEHK Companies With High Insider Ownership.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1302 SEHK:2005 and SEHK:806.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

雅虎香港財經

雅虎香港財經