Hilltop Holdings (HTH) Weak Asset Quality, Mortgage Volume Hurt

Hilltop Holdings Inc.’s HTH poor asset quality, weak Mortgage Origination segment performance and elevated expense base are major headwinds. Nonetheless, a sound balance sheet, high rates and restructuring initiatives offer support to some extent.

HTH’s deteriorating asset quality is a concern. The company witnessed a provision benefit in the first quarter of 2024 after a significant rise in provision for credit losses in 2023 and 2022. Amid the ongoing tough economic backdrop, provisions are anticipated to remain elevated in the near term. While we estimate provisions to dip this year, the metric is expected to witness a year-over-year jump of 149.4% in 2025.

Moreover, the weak performance of Hilltop Holdings’ Mortgage Origination segment is another headwind. Mortgage volumes decreased 1.3% in 2021, 44.2% in 2022 and 34.9% in 2023. The downtrend continued in the first quarter of 2024 as well. PrimeLending took several measures to tackle lower loan volumes and drags on profitability, including headcount reduction, branch consolidations and adjusting targeted fixed costs.

High mortgage rates will continue to put pressure on mortgage origination volumes, thus hurting the segment’s profitability. Further, slowed-down payment assistance programs will further cause a ripple effect, subduing the mortgage market activities. Per our estimates, the Mortgage Origination segment's non-interest income will decline 5% in 2024.

Additionally, HTH’s non-interest expenses are expected to remain high in the near term in light of ongoing investments in franchise and inflationary pressures. We estimate total non-interest expenses to increase 0.7% in 2024, 5.2% in 2025 and 3.8% in 2026.

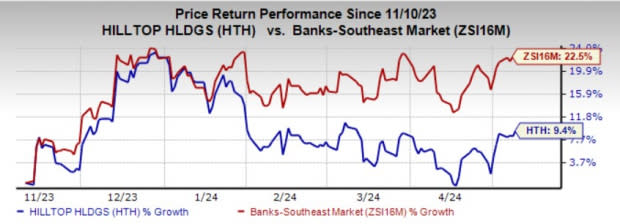

HTH Holdings currently carries a Zacks Rank #4 (Sell). Over the past six months, shares of the company have rallied 9.4%, underperforming the industry’s growth of 22.5%.

Image Source: Zacks Investment Research

Despite the abovementioned concerns, Hilltop Holdings is well placed to grow organically, driven by a sound balance sheet and high rates. Its restructuring initiatives will diversify revenue streams to boost fee income further.

Banking Stocks to Consider

Some better-ranked major bank stocks worth a look are Community Trust Bancorp, Inc CTBI and First BanCorp FBP, sporting a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks Rank #1 stocks here.

Estimates for CTBI’s current-year earnings have been revised 2.7% upward in the past month. The company’s shares have risen 13.7% over the past six months.

Estimates for FBP’s current-year earnings have been revised 6% upward in the past week. The company’s shares have surged 28.9% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hilltop Holdings Inc. (HTH) : Free Stock Analysis Report

Community Trust Bancorp, Inc. (CTBI) : Free Stock Analysis Report

First BanCorp. (FBP) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經