JPMorgan, BNY Mellon Mull Entering India Asset Management Market

Given that India’s asset management industry is rapidly growing, Wall Street firms like JPMorgan JPM and The Bank of New York Mellon Corporation BK are considering entry. According to people with knowledge of the matter, JPM and BK already have strategies ready on how they will operate in India.

JPM and BNY Mellon plan to begin operations in India in the next 12-18 months. However, the timelines for approaching SEBI to seek licenses to operate in the country’s asset management industry are not yet known.

Both firms will likely have different styles of entering the India markets. While JPMorgan’s execution strategy is not yet clear, BNY Mellon plans to enter India with its own products and distribution channel.

Per a source, “JPMorgan is looking at a few companies for acquisition and it is also open to equity partnerships with existing players.”

While BK will likely interview candidates for across positions, JPMorgan is looking at senior to mid-management positions.

If JPM’s plans work out, this will be the Wall Street giant’s re-entry into India’s asset management industry. Notably, in 2016, JPM decided to exit the India markets.

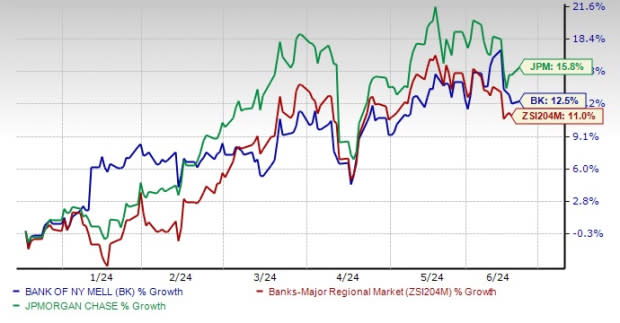

Over the past six months, JPM and BK shares have gained 15.8% and 12.5%, respectively, compared with the industry’s 11% growth.

Image Source: Zacks Investment Research

Currently, JPM and BNY Mellon carry a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other U.S. Firms Entering India

In July 2023, BlackRock BLK joined hands with Jio Financial Services Limited (“JFS”) in India to form Jio BlackRock in a 50:50 partnership.

The partnership brings together the scale and investment expertise of BLK, a globally renowned asset manager, with the local market knowledge and digital infrastructure capabilities of India-based JFS.

With the combined strengths of BLK and JFS, the partnership aims to democratize access to financial investments and foster financial well-being across India. Investors in the country can look forward to a new era of transformative investment opportunities with Jio BlackRock at the helm.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經