Medifast (MED) Tumbles More Than 40% in 3 Months: Here's Why

Medifast, Inc. MED appears in troubled waters. The company has been battling persistent customer acquisition challenges exacerbated by macroeconomic factors and the rising popularity of GLP-1 medications. Additionally, increased marketing and advertising initiatives and investments to drive customer acquisition are likely to put pressure on profits in 2024.

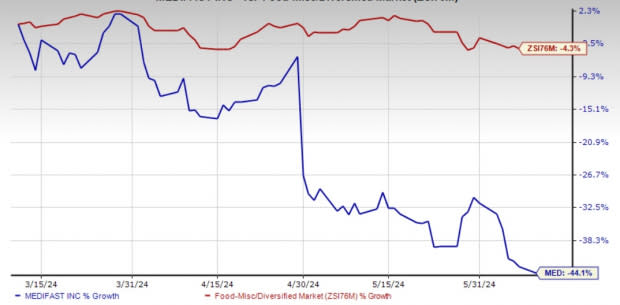

The Zacks Consensus Estimate for 2024 earnings per share has declined from $2.80 to 94 cents in the past 30 days. Additionally, this Zacks Rank #5 (Strong Sell) stock has slumped 44.1% in the past three months compared with the industry’s decline of 4.3%.

Customer Acquisition Challenges

Medifast has been encountering difficulties in attracting customers, primarily because of a range of macroeconomic elements, such as the increasing popularity of GLP-1 medications, the rapidly changing economy and shifts in social media algorithms. Undoubtedly, the weight loss market has experienced significant changes over the past 18 months, with the adoption of medically supported weight loss accelerating more rapidly than anticipated.

In the first quarter of 2024, net revenues of $174.7 million declined 49.9% year over year, mainly due to a fall in active earning OPTAVIA Coaches and reduced productivity per active earning OPTAVIA Coach. Average revenue per active earning OPTAVIA Coach was $4,623, down 22.2% from $5,945 due to lower customer acquisition stemming from the rising popularity of weight loss medicines. The total number of active earning OPTAVIA Coaches fell 35.6% to 37,800 compared with 58,700 in the year-ago quarter.

Unimpressively, the quarterly gross profit came in at $127.3 million, down 48.3% year over year on reduced revenues. Management expects revenues in the range of $150-$170 million for the second quarter of 2024 compared with the $296.2 million reported in the second quarter of 2023. The revenue outlook reflects continued near-term pressure on customer acquisition stemming from the growth of GLP-1 medications in markets.

Image Source: Zacks Investment Research

High Costs & Investments to Hurt Profits

Medifast has been battling rising SG&A costs for a while, which is denting its profits. As a percentage of revenues, SG&A expenses increased 1,300 bps to 68.3% in the first quarter of 2024. This was primarily attributed to market research and investment costs related to medically supported weight loss activities, reduced leverage on fixed costs resulting from decreased sales volumes, as well as costs associated with company-led acquisition initiatives. On an adjusted basis, SG&A expenses as a percentage of sales expanded 1,220 bps to 67.5%.

As the operating landscape remains difficult, Medifast intends to make significant spending to boost customer acquisition. The company plans to invest roughly $30 million in advertising and other marketing initiatives to enhance the visibility and customer engagement around the OPTAVIA brand and its offerings. This elevated level of spending is anticipated to continue into 2025.

However, these investments in customer acquisition initiatives, coupled with the negative impact of lower volumes on operating leverage, are expected to continue putting pressure on profitability for the remainder of 2024. The company projects earnings per share (EPS) in the band of 5-40 cents for the second quarter of 2024. The EPS guidance excludes costs associated with the initiation of a partnership with LifeMD, as well as any gains or losses related to changes in the market price of the company’s LifeMD investment. In the second quarter of 2023, earnings came in at $2.77 per share.

While Medifast has been proactively implementing a series of measures to propel its growth trajectory, the abovementioned obstacles cannot be ignored in the near term.

Better-Ranked Food Bets

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks and currently carries a Zacks Rank #2 (Buy). UTZ has a trailing four-quarter earnings surprise of 2% on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings implies growth of 26.3% from the year-ago reported numbers.

Conagra Brands CAG, a consumer-packaged goods food company, currently carries a Zacks Rank #2. The Zacks Consensus Estimate for CAG’s current fiscal-year earnings indicates a decline of 5.1% from the year-ago reported figure.

Conagra Brands has a trailing four-quarter earnings surprise of 6.8%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Conagra Brands (CAG) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經