MSC Industrial (MSM) Acquires ApTex & Premier Tool Grinding

MSC Industrial Direct Company, Inc. MSM announced that it acquired ApTex, Inc. and Premier Tool Grinding, Inc. This transaction will broaden MSC Industrial's product offerings and strengthen its regional presence.

According to the purchase agreements, both companies will continue to operate under their current names as MSC businesses.

ApTex is a production-oriented, highly technical metalworking distributor based in Waukesha, WI. It focuses on cutting tools, abrasives, metalworking fluids, and workholding systems and components. The company focuses on value-added services and solutions to drive cost savings through every step of customers' production processes.

MSM intends to combine its expanded product portfolio with ApTex's technological capabilities to provide additional cost savings to customers. Moreover, this acquisition will help MSC Industrial’s position to gain a share in the surrounding Wisconsin.

Premier Tool Grinding, headquartered in Goodyear, AZ, designs, manufactures, refurbishes, and coats carbide cutting tools . This deal will complement MSM's specialty tooling and regrinding service portfolio, which was recently expanded with the acquisition of Tru-Edge. The acquisition will expand MSC Industrial's footprint in the western United States.

In 2023, the two companies generated around $20 million in combined sales. Both acquisitions are estimated to have a net neutral impact on MSC's fiscal 2024 net income.

MSM reported preliminary net sales of $978-$980 million for the third fiscal quarter, which indicates a year-over-year decline of 7.3-7.1%. MSC Industrial generated revenues of around $935 million in the second quarter of fiscal 2024. Average daily sales increased around 3% sequentially.

Adjusted earnings per share for the third fiscal quarter are expected to be $1.32-$1.34, which suggests a decline from the $1.74 per share reported in the year-ago quarter. The company posted second-quarter fiscal 2024 adjusted earnings per share of $1.18.

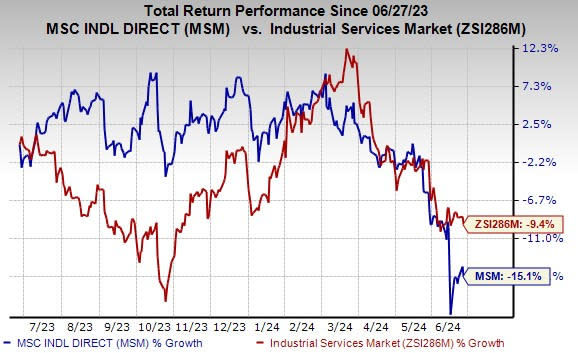

Price Performance

MSC Industrial’s shares have lost 15.1% in the past year compared with the industry’s decline of 9.4%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

MSC Industrial currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the Industrial Products sector are Intellicheck, Inc. IDN, Applied Industrial Technologies AIT and Cintas Corporation CTAS. IDN currently sports a Zacks Rank #1 (Strong Buy), and AIT and CTAS carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Intellicheck’s 2024 earnings is pegged at 2 cents per share. The consensus estimate for 2024 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 28.9%. IDN shares have gained 84.2% in a year.

Applied Industrial has an average trailing four-quarter earnings surprise of 8.2%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.62 per share, which indicates year-over-year growth of 9.9%. Estimates have moved north by 2% in the past 60 days. The company’s shares have gained 8.8% in a year.

The Zacks Consensus Estimate for Cintas’ 2024 earnings is pegged at $14.95 per share. The consensus estimate for 2024 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 4.3%. CTAS shares have gained 13.7% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cintas Corporation (CTAS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

MSC Industrial Direct Company, Inc. (MSM) : Free Stock Analysis Report

Intellicheck Mobilisa, Inc. (IDN) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經