Novartis (NVS) Reports Positive Long-Term Data on CSU Drug

Novartis NVS announced new long-term efficacy and safety data from the late-stage studies REMIX-1 and REMIX-2 studies evaluating remibrutinib for the treatment of chronic spontaneous urticaria (CSU).

REMIX-1 (NCT05030311) and REMIX-2 (NCT05032157) are two identically designed, global, multicenter, randomized, double-blind, parallel-group, placebo-controlled phase III studies, having 470 and 455 participants, respectively.

Remibrutinib, an oral Bruton’s tyrosine kinase inhibitor, demonstrated a favorable and consistent safety profile for up to one year, including balanced liver function tests versus placebo.

CSU is a medical term for chronic hives that last for six weeks or longer, where the underlying cause is internal rather than exposure to any allergen or external trigger.

New long-term data from these studies assessed at week 52 showed significant improvements with remibrutinib as compared to placebo, counting in weekly urticaria activity score (UAS7), weekly itch severity score (ISS7) and weekly hive severity score (HSS7).

These data are consistent with those at week 12 and confirmed at week 24.

Patients receiving placebo were transitioned to remibrutinib at week 24. Responses with remibrutinib were observed as early as the first week after switching and were sustained until the end of the study (28 weeks of treatment).

As assessed at week 52, almost half of the patients were completely free of itch and hives (UAS7=0) as assessed at week 52.

NVS continues to evaluate remibrutinib in multiple immune-mediated conditions such as hidradenitis suppurativa, food allergy, chronic inducible urticaria and multiple sclerosis.

Novartis earlier reported that remibrutinib met all primary endpoints (REMIX-1 and REMIX-2) in patients with CSU, who remained symptomatic despite second-generation H1-antihistamine use.

Novartis intends to submit remibrutinib for approval in CSU to global health authorities in the second half of the year.

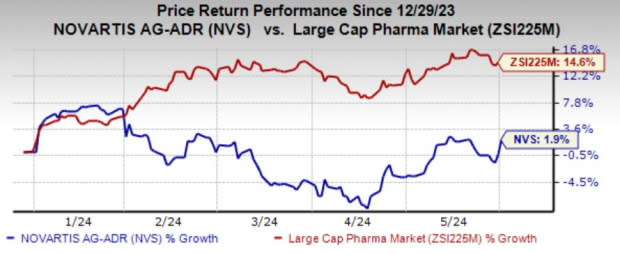

Shares of Novartis have risen 1.9% in the year-to-date period compared with the industry’s growth of 14.6%.

Image Source: Zacks Investment Research

A potential approval of remibrutinib would offer an effective oral option within the Novartis immunology portfolio, which currently comprises Xolair (omalizumab).

Xolair is the first and only injectable biologic indicated for CSU. In February 2024, the FDA expanded Xolair’s label for the reduction of allergic reactions, including anaphylaxis, which may occur with accidental exposure to one or more foods in adult and pediatric patients aged one year and older with IgE-mediated food allergy.

Novartis has a collaboration agreement with Roche RHHBY for Xolair.

While NVS and RHHBY develop and co-promote Xolair in the United States, Novartis records all sales of Xolair outside the country.

Zacks Rank & Stocks to Consider

Novartis currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the healthcare sector are ALX Oncology Holdings ALXO and Krystal Biotech KRYS, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73.

ALX Oncology beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for KRYS’ earnings per share has increased 17 cents to $2.06. KRYS beat on earnings in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 21.46%. Shares of Krystal Biotech have surged 31.3% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Krystal Biotech, Inc. (KRYS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經