Reasons to Add Public Service Enterprise (PEG) to Your Portfolio

Public Service Enterprise Group’s PEG strategic investments in infrastructure projects and focus on expanding renewable assets will help the company boost customers’ satisfaction. Given its growth opportunities, PEG is a solid investment option in the utility sector.

Let us focus on the reasons that make this Zacks Rank #2 (Buy) stock a robust investment pick at the moment.

Growth Projections & Surprise History

The Zacks Consensus Estimate for PEG’s 2024 earnings per share (EPS) has increased 0.3% to $3.67 in the past 60 days. The estimate also implies an improvement of 5.5% from the 2023 reported earnings figure.

The company’s long-term (three to five years) earnings growth is pegged at 5.4%. It delivered an average earnings surprise of 7.30% in the last four quarters.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing its funds to generate higher returns. Currently, PEG’s ROE is 11.1% compared with the industry’s 9.59%. This indicates that the company has been utilizing its funds more constructively than its peers in the industry.

Solvency

Public Service Enterprise Group’s times interest earned ratio (TIE) at the end of the first quarter of 2024 was 3.7. The TIE ratio of more than 1 indicates that the company will be able to meet its interest payment obligations in the near term without any problems.

At the end of the first quarter of 2024, PEG’s total debt to capital was 58.09%, better than the industry’s average of 59.66%.

Dividend History

Public Service Enterprise Group has been increasing shareholder value through dividend payments. In April 2024, PEG announced a quarterly dividend of 60 cents per share, which resulted in an annual dividend of $2.40 per share. PEG’s current dividend yield is 3.23%, better than the Zacks S&P 500 composite’s yield of 1.28%.

Systematic Investments

Strategic capital investments are making PEG’s infrastructure stronger and more resilient. The company aims for capital expenditure worth $18-$21 billion for the 2024-2028 period. These systematic investments are expected to drive PEG’s annual rate base growth of 6%-7.5% for the above-mentioned period.

As part of its renewable energy portfolio expansion, PEG is making efforts to support offshore wind development in the New Jersey area. The company is also undertaking solar initiatives at PSE&G, which primarily invests in utility-owned solar photovoltaic (PV) grid-connected solar systems installed on PSE&G property and third-party sites as part of its clean energy expansion plan.

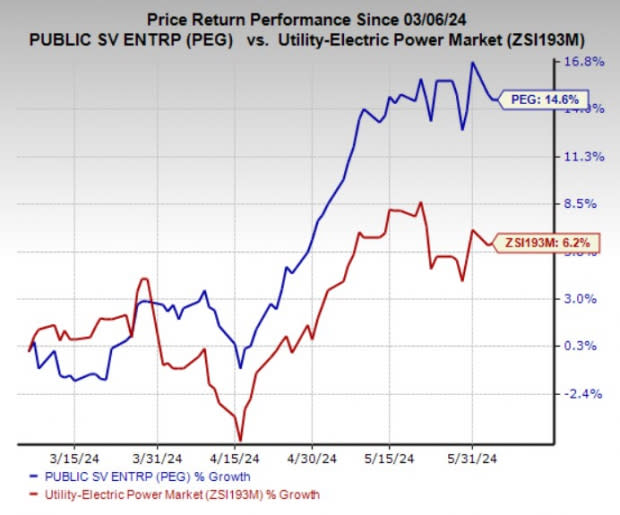

Price Performance

In the past three months, PEG shares have risen 14.6% against the industry’s return of 6.2%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the same industry are CenterPoint Energy CNP, DTE Energy DTE and Pinnacle West Capital PNW, each holding a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CNP’s long-term earnings growth rate is 7%. The Zacks Consensus Estimate for CNP’s 2024 sales is pegged at $8.78 billion, which indicates a year-over-year improvement of 1%.

DTE’s long-term earnings growth rate is 8.2%. The Zacks Consensus Estimate for DTE’s 2024 sales is pegged at $12.96 billion, which implies a year-over-year improvement of 1.7%.

PNW’s long-term earnings growth rate is 8.2%. The Zacks Consensus Estimate for PNW’s 2024 sales is pegged at $12.96 billion, which suggests year-over-year growth of 4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經