Salesforce (CRM) in Takeover Talks With Informatica Per Reports

Salesforce, Inc. CRM is reportedly in advanced discussions to acquire Informatica Inc. INFA, a leading provider of enterprise cloud data management and integration solutions. If the deal materializes, it will be the biggest acquisition deal by Salesforce since the takeover of Slack Technologies in 2020 for approximately $28 billion. At a closing price of $38.48 per share as of Apr 12, Informatica has a market capitalization of $11.4 billion.

Acquisition to Boost Data Capabilities

While neither company has officially confirmed the talks, such a move could have significant implications for both Salesforce and the broader enterprise software market.

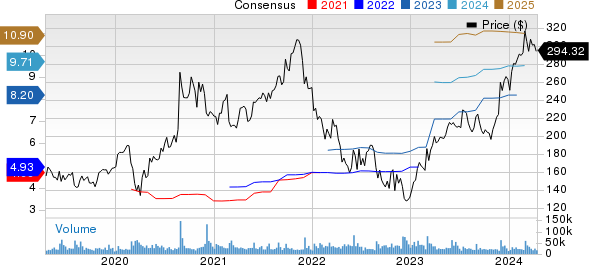

Salesforce Inc. Price and Consensus

Salesforce Inc. price-consensus-chart | Salesforce Inc. Quote

If the acquisition materializes, it will mark a strategic move by Salesforce to bolster its capabilities in data integration and management, a crucial aspect of its CRM (Customer Relationship Management) platform. Informatica's expertise in data integration, data quality and data governance will complement Salesforce's existing suite of cloud-based services, enabling the company to offer a more comprehensive solution to its customers.

For Salesforce, acquiring Informatica could provide several key benefits. Firstly, it would enhance Salesforce's ability to help businesses harness the power of their data by providing seamless integration with various data sources and systems. This could improve customer insights, drive more personalized interactions and ultimately enhance the overall customer experience.

Additionally, Informatica's established presence in the enterprise market could open up new opportunities for Salesforce to expand its reach beyond its traditional customer base. With Informatica's extensive customer network and partnerships, Salesforce could strengthen its position in industries such as finance, healthcare and manufacturing, where data management and integration are paramount.

From Informatica's perspective, being acquired by Salesforce could offer access to greater resources and scale, enabling the company to accelerate its innovation and product development efforts. Moreover, aligning with Salesforce's strong brand and market presence could enhance Informatica's credibility and competitiveness in the rapidly evolving enterprise software landscape.

Tech M&A Deals Continue in 2024

So far, 2024 has been witnessing robust merger and acquisition (M&A) activities following a lackluster 2023. According to a Bloomberg report, M&A deals in 2023 fell to $2.17 trillion from a record of $3.82 trillion in 2021.

The first mega deal was announced in January 2024, wherein Hewlett Packard Enterprise Company HPE agreed to buy Juniper Networks, Inc. JNPR in a deal worth $14 billion. The acquisition deal underlines Hewlett Packard Enterprises' relentless focus on fortifying its networking business, aligning with the burgeoning demand for high-growth solutions in the evolving tech landscape.

The acquisition aims to reshape the company’s portfolio mix by driving emphasis toward accelerated growth avenues, especially in networking, while reinforcing its high-margin business segments. This alignment will propel Hewlett Packard Enterprises' trajectory toward sustainable and profitable growth, leveraging Juniper Networks' prowess in AI-native networks and significantly amplifying HPE's networking arm.

This year’s largest acquisition deal was also announced in January, wherein Synopsys agreed to acquire smaller rival ANSYS in a cash and stock transaction valued at $35 billion. The merger between Synopsys and ANSYS holds profound implications for the semiconductor landscape.

Synopsys, a stalwart in electronic design automation, and ANSYS, renowned for its engineering simulation software, are poised to create a synergistic powerhouse. This strategic alliance aims to revolutionize semiconductor design and testing processes, bringing about a holistic approach to innovation.

Overall, the robust M&A activity in the technology sector underscores the importance of agility and strategic foresight in navigating an ever-changing business environment. These transactions are reshaping the competitive landscape and positioning companies for long-term growth and success in the digital age.

Currently, Salesforce, Informatica and Hewlett Packard Enterprise each carry a Zacks Rank #3 (Hold), while Juniper Networks has a Zacks Rank #4 (Sell). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Informatica Inc. (INFA) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經