Spectrum Brands' (SPB) Focus on Growth Endeavors Aids Momentum

Spectrum Brands Holdings Inc. SPB has retained its niche in the market, driven by its progress on the four core pillars, which position it for long-term growth. Additionally, its cost take-out endeavors and focus on its Global Productivity Improvement Plan (“GPIP”) have been boosting its operating performance. The company is anticipated to stay strong on its balance sheet position, which enables it to invest in its business.

However, soft sales trends due to lower demand, particularly in the small kitchen appliance category, have been weighing on the Home & Personal Care (HPC) segment’s results. Notably, the soft demand for small kitchen appliances, volume declines in certain pet channels, and the impacts of SKU rationalizations hurt the top line in the second quarter of fiscal 2024.

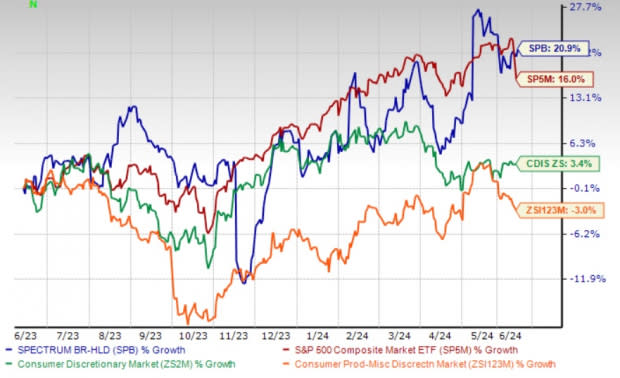

Shares of the Zacks Rank #3 (Hold) company have gained 20.9% in the past year against the industry’s decline of 3%. SPB also compared unfavorably with the Consumer Discretionary sector’s growth of 3.4% and the S&P 500’s improvement of 16% in a year.

Image Source: Zacks Investment Research

Why Spectrum Brands is a Stock to Watch?

SPB is progressing well with GPIP, which aims at improving the company's operating efficiency and effectiveness, while focusing on consumer insights and growth-enabling functions, including technology, marketing, and research and development.

Most of the savings are expected to be reinvested into growth initiatives and consumer insights, R&D, and marketing across each of the businesses. This plan will also enable the company to deliver value creation and sustainable growth in the long term.

Spectrum Brands is anticipated to retain its business strength through its four core pillars focused on streamlining its organizational structure and re-energizing the employee base. It is committed to improving operational efficiencies throughout and limiting risk. Management is protecting and deleveraging its balance sheet, while solidifying liquidity.

The company is focused on transforming into a pure-play global Pet and Home & Garden business. As part of the strategic transformation plan, it completed the sale of HHI to ASSA ABLOY on Jun 20, 2023. With the sale of the HHI business, the company can refocus on its core businesses and boast a stronger balance sheet.

Spectrum Brands’ results continue to reflect gains from increased pricing, cost improvements and a favorable mix. This aided margins in fourth-quarter fiscal 2023. The company has been proactive in its cost-takeout actions implemented in the second half of fiscal 2022, including fixed cost reduction by eliminating permanently salaried headcount and reducing advertising and promotional spending. These actions helped mitigate the EBITDA decline to some extent.

Driven by improved pricing and cost improvements, the gross margin expanded 870 bps to 38.1% in second-quarter fiscal 2024, whereas gross profit improved 27.5% year over year. Adjusted EBITDA advanced 120.2% year over year to $112.3 million in the fiscal second quarter. The adjusted EBITDA margin expanded 860 bps year over year to 15.6%, driven by better gross margins and lower operating expenses.

Spectrum Brands projects flat year-over-year sales for fiscal 2024. Adjusted EBITDA, excluding the investment income, is likely to grow in the low-double digits.

Hiccups to Persist

Spectrum Brands suffers from category decline trends for the Home & Personal Care segment, particularly in kitchen appliances, continued retailer inventory management in North America and the exit of certain small Kitchen Appliance SKUs. This impacted the segment’s sales in second-quarter fiscal 2024. Going forward, the company anticipates continued pricing pressure in the HPC segment in fiscal 2024 as competition is likely to remain fierce.

Stocks to Consider

We have highlighted three better-ranked stocks from the Consumer Discretionary sector, namely Lifetime Brands LCUT, Crocs CROX and Kontoor Brands KTB.

Lifetime Brands, which designs, sources and sells branded kitchenware, tableware and other products for use in homes worldwide, currently has a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 12.1%, on average. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Lifetime Brands’ current financial year’s sales and earnings per share suggests growth of 1.9% and 40.4%, respectively, from the year-ago period’s reported figures.

Crocs is one of the leading footwear brands with its focus on comfort and style. The company has a trailing four-quarter earnings surprise of 17.1%, on average. CROX currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Crocs’ current financial-year sales and EPS suggests growth of 4.4% and 5.2%, respectively, from the year-ago period's reported figures.

Kontoor Brands is an apparel company. KTB has a trailing four-quarter earnings surprise of 13%, on average. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Kontoor Brands’ current financial-year sales and earnings suggests growth of 0.1% and 11%, respectively, from the year-ago period's reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Spectrum Brands Holdings Inc. (SPB) : Free Stock Analysis Report

Lifetime Brands, Inc. (LCUT) : Free Stock Analysis Report

Kontoor Brands, Inc. (KTB) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經