T-Mobile (TMUS) Boosts Network With US Cellular Asset Buyout

In a concerted effort to bridge the digital divide and strengthen its leading market position, T-Mobile US Inc. TMUS has inked a definitive agreement with United States Cellular Corporation USM to acquire substantially all of the latter’s wireless operations along with 30% of its spectrum assets across several spectrum bands.

T-Mobile will pay an aggregate of $4.4 billion, including a combination of cash and up to approximately $2 billion of assumed debt. The transaction is likely to close midway next year, subject to the fulfillment of mandatory closing conditions and other regulatory approvals. Telephone and Data Systems, Inc., which boasts about 83% ownership stake in US Cellular, has unanimously agreed to the deal to help unlock significant value for its wireless customers and shareholders.

Post the deal closure and successful integration, millions of US Cellular customers, particularly in the underserved rural areas, are likely to get seamless access to superior connectivity and nationwide coverage of one the largest and fastest 5G networks of T-Mobile. In addition, US Cellular customers will have the opportunity to enjoy the Un-carrier’s industry-leading value-packed plans filled with benefits and perks such as streaming and free international data roaming along with best-in-class customer support without any switching costs.

The transaction is likely to facilitate a competitive market with increased options and enable T-Mobile to expand its fast-growing home broadband offerings and fixed wireless products by tapping into the additional capacity and coverage created through the combined spectrum and wireless assets. The Un-carrier will also lease space on various US Cellular towers to ensure continued, uninterrupted service for its customers.

On the other hand, the deal will enable US Cellular to improve its liquidity and reduce its debt burden, with an option to opportunistically monetize the retained 70% of total spectrum assets. Moreover, the company will enjoy a steady revenue stream with T-Mobile as its anchor tenant on a minimum of 2,015 incremental towers for 15 years in addition to approximately 600 towers where it already serves as a tenant. The transaction is, therefore, a win-win deal for both companies.

Moving forward, T-Mobile is likely to gain significant market share by tapping into US Cellular's network assets. By offering competitive pricing and prioritizing customer satisfaction, T-Mobile is well-positioned to solidify its presence in the broadband market while driving growth and profitability in the long term.

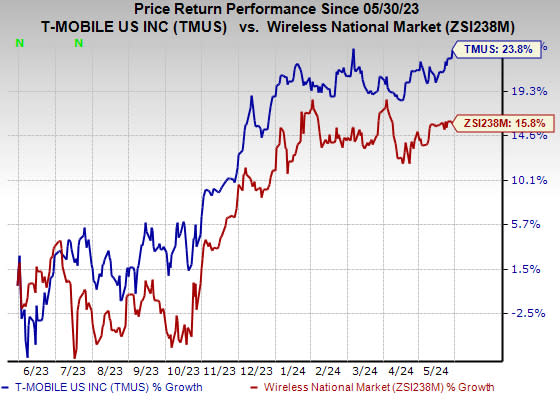

Shares of the company have gained 23.8% in the past year compared with the industry’s rise of 15.8%.

Image Source: Zacks Investment Research

T-Mobile currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Arista Networks, Inc. ANET, sporting a Zacks Rank #1, is a key stock from the broader industry. It is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Ubiquiti Inc. UI, carrying a Zacks Rank #2 (Buy) at present, is another key pick in the broader industry. Headquartered in New York, it offers a comprehensive portfolio of networking products and solutions for service providers and enterprises at disruptive prices.

It boasts a proprietary network communication platform that is well-equipped to meet end-market customer needs. In addition, it is committed to reducing operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Cellular Corporation (USM) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經