Three Swiss Dividend Stocks Offering Yields From 4% To 5%

The Switzerland market recently closed lower, reflecting broader European trends as investors await key economic data from the U.S. that could influence future interest rate decisions by the Federal Reserve. Amid these uncertain market conditions, dividend stocks remain a focus for investors seeking steady income streams, particularly those offering yields between 4% to 5%.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.46% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.15% | ★★★★★★ |

Compagnie Financière Tradition (SWX:CFT) | 4.29% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.44% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.34% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.35% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.79% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.07% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.80% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.19% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

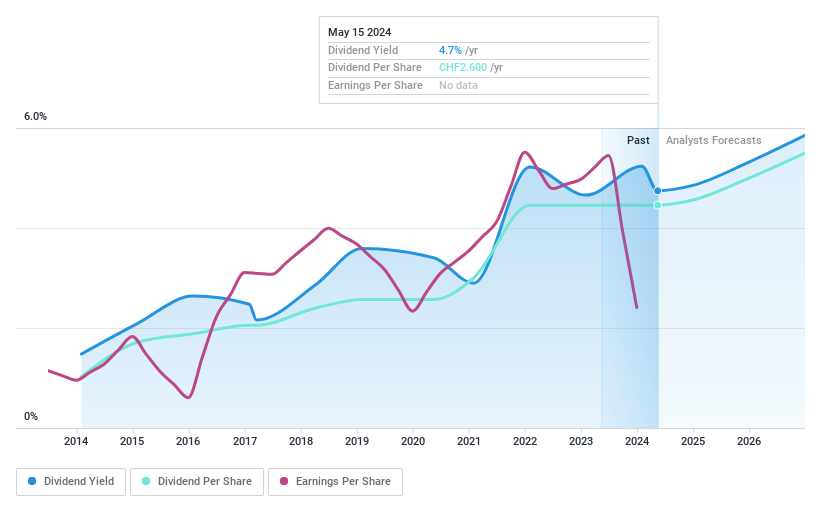

Julius Bär Gruppe

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Julius Bär Gruppe AG is a global wealth management firm operating in Switzerland, Europe, the Americas, and Asia, with a market capitalization of approximately CHF 10.50 billion.

Operations: Julius Bär Gruppe AG generates CHF 3.24 billion from its private banking segment.

Dividend Yield: 5.1%

Julius Bär Gruppe offers a dividend yield of 5.07%, ranking in the top 25% of Swiss dividend payers, but its sustainability is questionable with a high payout ratio of 117.8% and earnings coverage concerns. Despite this, dividends have shown reliability and stability over the past decade. The firm's profit margin has declined from 24.6% to 14%, yet earnings are expected to grow by 21.88% annually. Recent executive changes could influence operations, as Benjamin Sim was appointed group head Greater China Singapore, effective June 2024.

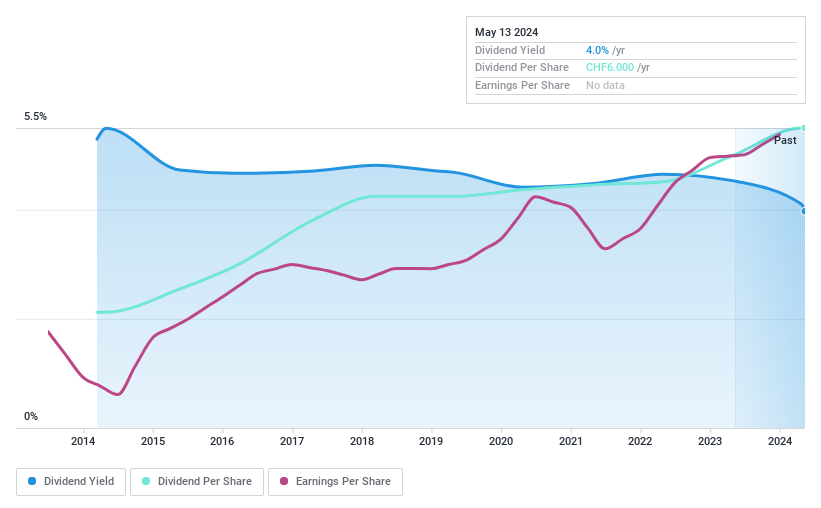

Compagnie Financière Tradition

Simply Wall St Dividend Rating: ★★★★★★

Overview: Compagnie Financière Tradition SA, a global interdealer broker of financial and non-financial products, has a market capitalization of CHF 1.09 billion.

Operations: Compagnie Financière Tradition SA generates revenue primarily from three geographic segments: Americas (CHF 350.89 million), Asia-Pacific (CHF 271.44 million), and Europe, Middle East, and Africa (CHF 431.78 million).

Dividend Yield: 4.3%

Compagnie Financière Tradition reported a revenue increase to CHF 983.3 million and net income to CHF 94.42 million in 2023, with dividends per share growth over the last decade, reflecting a stable dividend policy. The company's dividend yield stands at 4.29%, higher than the Swiss market average, supported by earnings and cash flow with payout ratios of 47.2% and 40.8% respectively, indicating sustainability despite its highly volatile share price recently.

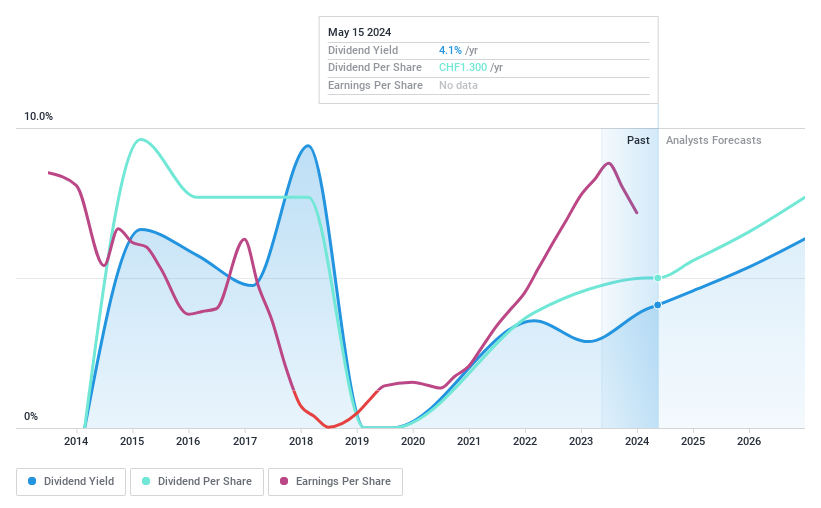

Meier Tobler Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG is a trading and services company specializing in heat generation and air conditioning systems, with a market capitalization of CHF 365.74 million.

Operations: Meier Tobler Group AG generates CHF 104.67 million from services and CHF 441.25 million from distribution in the heating and air conditioning market.

Dividend Yield: 4%

Meier Tobler Group offers a dividend yield of 4.01%, slightly below the Swiss market's top quartile. While trading at a substantial 63.6% below its estimated fair value, it provides attractive pricing relative to its peers and industry standards. The dividends are well-supported with a payout ratio of 54.8% from earnings and a cash payout ratio of 50.7%. However, investors should note the company's decade-long history of unstable and volatile dividend payments, despite recent increases in dividend distribution.

Unlock comprehensive insights into our analysis of Meier Tobler Group stock in this dividend report.

Key Takeaways

Delve into our full catalog of 28 Top Dividend Stocks here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BAER SWX:CFT and SWX:MTG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

雅虎香港財經

雅虎香港財經