Why You Should Buy ConocoPhillips (COP) After Q1 Earnings Beat

ConocoPhillips COP recently reported better-than-expected first-quarter 2024 earnings. The leading exploration and production company’s earnings per share were $2.03, while revenues came in at $14.5 billion.

Good Entry Point for Investors

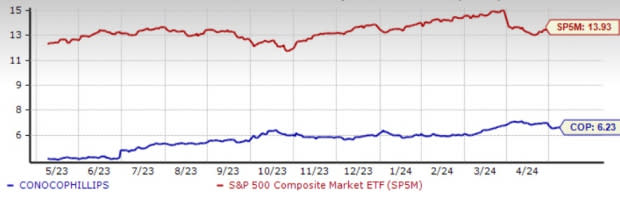

Although the quarterly earnings beat the Zacks Consensus Estimate, the stock price fell marginally, a movement unrelated to the company's fundamentals. The stock is cheap on a relative basis, and the current affordability of the stock is evident from its trailing 12-month enterprise value-to-EBITDA (EV/EBITDA) ratio, which stands at 6.23, notably lower than the Zacks S&P 500 composite average of 13.93.

Image Source: Zacks Investment Research

ConocoPhillips' robust business model is evident from its solid production outlook, thanks to its decades of drilling inventories across its low-cost and diversified upstream asset base. The resource base represents the company’s strong footprint in prolific acres in the United States, comprising Eagle Ford shale, the Permian Basin and Bakken shale. ConocoPhillips boasted that drilling and completion activities are increasingly becoming efficient in all the key U.S. basins.

Compared to composite stocks belonging to the industry, the leading upstream energy company has considerably lower exposure to debt capital. This reflects that COP is better positioned to rely on its strong balance sheet to withstand any adverse business scenario. The upstream energy giant is also committed to returning capital to shareholders through both dividend payments and share repurchases.

Closing Thoughts

Given its diverse asset base, strong balance sheet and a firm dedication to returning capital to shareholders, investors should seriously consider purchasing COP, which currently carries a Zacks Rank #2 (Buy), without hesitation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Energy Giants

Exxon Mobil Corporation XOM and Chevron Corporation CVX are the two integrated energy giants that have already reported first-quarter earnings. While ExxonMobil missed the Zacks Consensus Estimate of earnings for the first quarter, Chevron beat the consensus estimate for the same.

One of the largest integrated energy firms, Shell plc SHEL, has also reported earnings. The company said that it has once again achieved a quarter marked by robust financial and operational performance. Apart from reducing emissions, Shell is also showcasing its strong commitment to generating handsome value for shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經