Why You Should Retain Synchrony (SYF) Stock in Your Portfolio

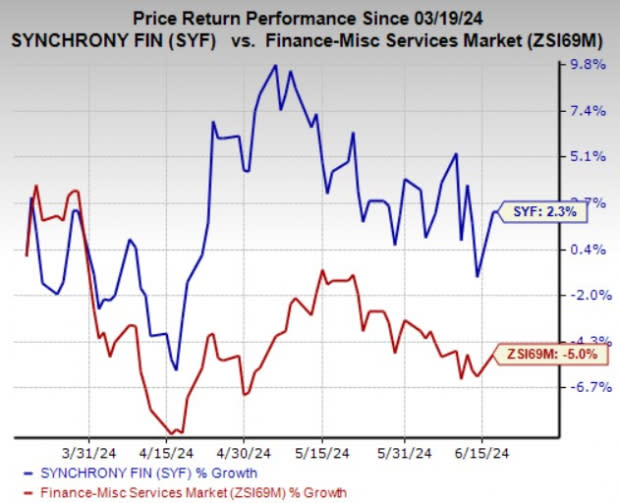

Synchrony Financial SYF is well-poised to grow on the back of higher interest earned, thanks to a high-interest rate environment, expanding average loan receivables, developing digital capabilities and elevated benchmark rates. Its balance sheet strength is a major positive. Over the past three months, the stock has gained 2.3% against the industry’s average decline of 5%.

Synchrony — with a market cap of $17.3 billion — is a premier consumer financial services company that offers a wide range of credit products. Courtesy of solid prospects, this Zacks Rank #3 (Hold) stock is worth retaining in your portfolio at the moment.

Image Source: Zacks Investment Research

Business Tailwinds

Rising interest rates, a strong labor market and normalizing payment rates should further fuel growth in net interest income. The company’s Health & Wellness platform is expected to continue its growth track thanks to a solid CareCredit brand. SYF’s focus on growing the brand with partnerships and collaborations is noteworthy. The company recently added and renewed partnerships with 25-plus partners in the first quarter of 2024. It also entered into a partnership with BRP and added technology partnerships with Adit Practice Management Software and ServiceTitan.

Dual and co-branded cards comprised 42% of the total purchase volume in the first quarter. Synchrony is enhancing its core value proposition by expanding its product utility, enabling customers to use digital wallets, make out of partner purchases and get rewarded.

The Zacks Consensus Estimate for SYF’s 2024 earnings is pegged at $5.71 per share, which indicates an increase of 10% year over year. Synchrony beat on earnings in three of the last four quarters and missed once, the average surprise being 1.1%. This is depicted in the graph below.

The consensus mark for current-year net interest income is $18.1 billion, suggesting a 6.2% rise from the prior-year reported number. The company expects net interest income to be around $17.5-$18.5 billion in 2024. Our estimate indicates a significant increase in interest on credit cards, which is likely to support the top-line growth.

The Health & Wellness platform witnessed 11% year-over-year growth in average active accounts in the first quarter of 2024. Our estimate for 2024 indicates a further increase of 6.2%. We expect loan receivables to witness a nearly 18.9% jump this year. The company expects total loan receivables to grow approximately 6-8% in 2024, following an 11.4% increase witnessed in 2023.

SYF exited the first quarter with cash and equivalents of $20 billion, which increased from $14.3 billion in 2023 end. It has a total debt to capital of 51.4%, lower than the industry average of 55.9%. Its balance sheet health supports shareholder value-boosting measures. Synchrony also completed the sale of its Pets Best subsidiary, which freed up capital for the company.

SYF completed its acquisition of Ally Financial’s point-of-sale business. This indicates that the company is utilizing its resources well by investing in new areas. This bodes well for SYF’s strategy of enhancing its market position with synergistic acquisitions.

In the March quarter alone, it returned capital worth $402 million through share repurchases of $300 million and paid common stock dividends of $102 million. The company’s board approved a new share repurchase plan to buy shares worth $1 billion through Jun 30, 2025, leaving it with a remaining share buyback capacity of $1.3 billion. Its dividend yield of 2.3% compares favorably with the industry average of 2.2%.

Key Risks

However, there are a few factors that investors should keep an eye on.

Although the continuous high-interest rate environment is helping Synchrony earn higher interest income, it will likely affect consumers’ spending levels. Also, losses are expected to build up on cards, as well as office real estate. Moreover, it expects net charge-offs for 2024 to be in the range of 5.75-6%, which suggests a significant increase from the 2023 reported figure of 4.87%. Nevertheless, we believe that a systematic and strategic plan of action will drive SYF’s growth in the long term.

Stocks to Consider

Some better-ranked stocks in the broader Finance space are StepStone Group LP STEP, Virtu Financial, Inc. VIRT and Axos Financial, Inc. AX. StepStone Group and Virtu Financial sport a Zacks Rank #1 (Strong Buy), while Axos Financial carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for StepStone Group’s 2024 earnings is pegged at $1.70 per share, which remained stable over the past week. STEP beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 15.7%.

The Zacks Consensus Estimate for Virtu Financial’s 2024 earnings is pegged at $2.48 per share, which remained stable over the past week. The consensus mark for VIRT’s revenues in 2024 is pegged at $1.3 billion.

The Zacks Consensus Estimate for Axos Financial’s 2024 earnings is pegged at $7.72 per share, which indicates a year-over-year increase of 52.3%. The estimate remained stable over the past month. AX beat earnings estimates in each of the past four quarters, with an average surprise of 12.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synchrony Financial (SYF) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

AXOS FINANCIAL, INC (AX) : Free Stock Analysis Report

StepStone Group Inc. (STEP) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經