3 High-Margin Stocks Swimming in Record Profits

High-margin stocks generally trade at fat premiums on the stock market. But that’s for good reason. Most of these companies are among the safest stocks you can buy.

On the flip side, these businesses are often mature and don’t provide flashy growth. This doesn’t mean that there isn’t any upside potential, though. Many of these businesses are expanding through acquisitions, or just enriching their shareholders by returning cash through buybacks and dividends.

Cash is king, and all this cash can come in handy during a potential downturn. April’s inflation data is set to come out on Wednesday, and analysts expect inflation to stay unchanged or decline slightly by 0.1%. If we see this data edge up even slightly, we could see another selloff, as that would likely mean the Federal Reserve will put rate cuts off the table for longer. I believe this could all turn out to be a storm in a teacup, but it’s better to be prepared.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

The following high-margin stocks can insulate you from the downturn in both the near- and long-term.

Kaspi.kz (KSPI)

Source: shutterstock.com/ZinetroN

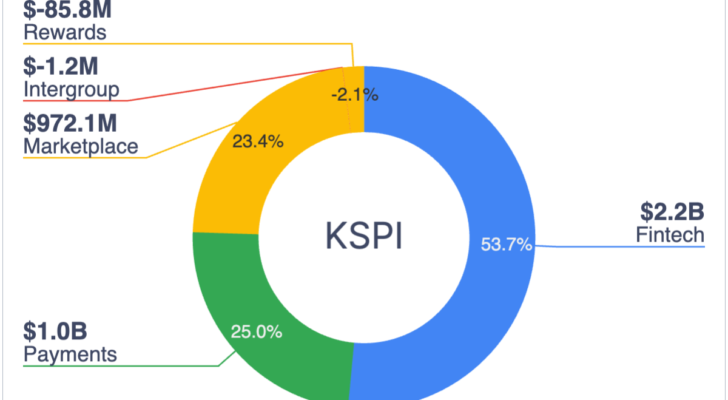

Kaspi.kz (NASDAQ:KSPI) is a fintech company based in Kazakhstan.

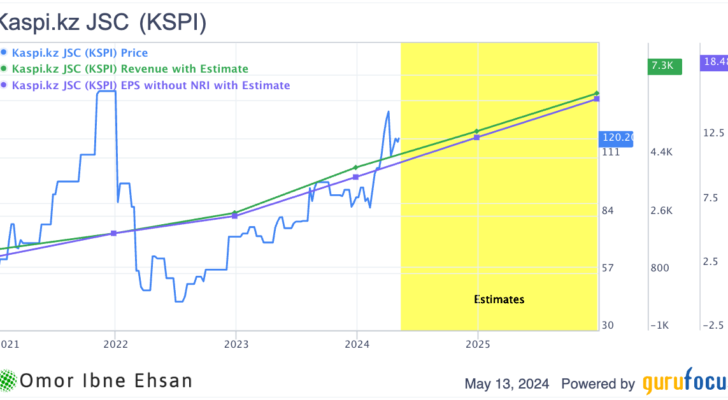

Source: Chart courtesy of GuruFocus.com

The company had a very good start to the year despite challenges, highlighting the strengths of having different business units. While Kaspi’s net profit margin declined by 9.7% year-over-year, this was largely due to the fact the company had to pay more interest on its existing loans, which sat around $1.2 billion for all of 2023. Kazakhstan’s inflation rate came in at 16.75% in 2022, hitting 15.75% in 2023 as inflation has moderated. However, revenue growth strongly outpaced inflation, surging 40.3% in Q1, which was helped by excellent growth in all areas of the business. The stock is up 44.5% over the past year, reflecting this growth.

Source: Chart courtesy of GuruFocus.com

The company’s earnings per share are expected to grow by around 25% annually in the coming years, and you’re paying just 9-times forward earnings. Sales are also expected to grow at around the same pace. Russia’s troubles are also beneficial for this company, and while Kazakhstan is a big country, it has a small population (similar to that of NY state). However, with fertility rates soaring and Russian immigrants pouring in, there are notable catalysts worth watching for this company.

Public Storage (PSA)

Source: Ken Wolter / Shutterstock.com

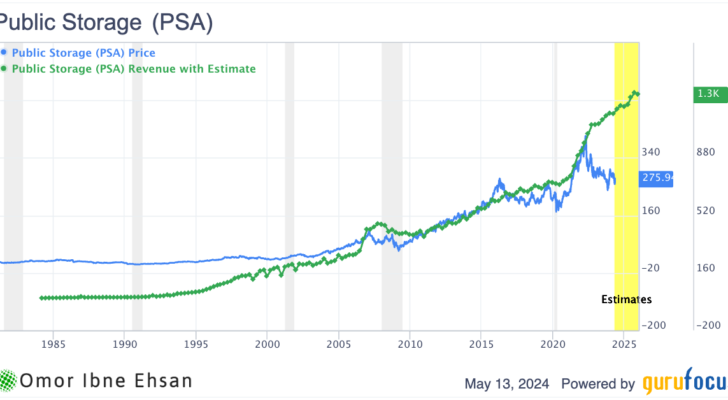

Public Storage (NYSE:PSA) had a solid start to the new year, once again highlighting the strength of its top-quality self-storage properties.

While the company’s funds from operations (FFO) declined 1.2% compared to last year, this dip mainly reflected very tough comparisons to their exceptionally strong performance in 2023. The company’s underlying fundamentals remained solid, with revenue growing 5.7%. I expect this trend to continue, albeit at a modest pace.

Source: Chart courtesy of GuruFocus.com

The company continues to benefit from steady long-term trends that are drawing more customers to self-storage. However, what really sets Public Storage apart is its excellent operating system. The company’s very high occupancy rate of 87.7% shows the company’s ability to maximize profits, even as markets change. Public Storage sports a solid net margin of 43.8%, supporting this thesis.

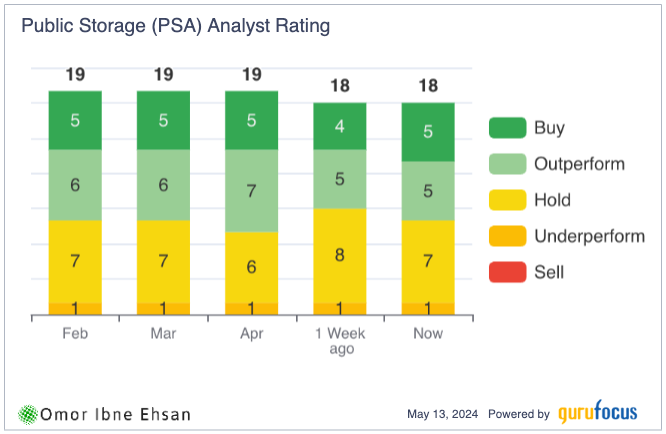

Public Storage is well-positioned to expand further as the clear leader in self-storage. The dividend yield here is an impressive 4.35%, driven by the company’s profitability. I think once treasury yields and interest rates fall below that level, this stock could become very attractive. It’s definitely one of the best high-margin stocks you can buy right now.

Source: Chart courtesy of GuruFocus.com

Texas Pacific Land Corporation (TPL)

Source: stockwars / Shutterstock.com

Texas Pacific Land Corporation (NYSE:TPL) had an incredible first three months of the year. The company really showed the tremendous earnings power of their unique asset holdings in the Permian Basin region.

Consolidated revenue for the company jumped 19% compared to the previous quarter. Nearly half of that total consolidated revenue came from their surface operations segment alone. As such, the stock is up 36.5% in the past year. However, I think TPL stock can rise much higher as earnings expand.

Source: Chart courtesy of GuruFocus.com

Notably, one of the most bullish recent developments for the company was its unveiling of promising new technology for treating water produced during oil and gas operations. If they can get this desalination process to work effectively, it could open up whole new potential revenue streams, while also helping with the growing challenge of dealing with all that produced water. There has been a lot of interest from oil and gas producers in this proposed technique, given how it may help lower disposal costs and allow for more water to be reused.

This is a company that provides a 65.7% net margin as of Q1 and a net cash position of $837 million, with no debt. That said, you are definitely paying a hefty premium for this quality. The stock trades at 33-times earnings, though I do think there is more room to run. The forward dividend yield here is 0.75%.

On the date of publication, Omor Ibne Ehsan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Omor Ibne Ehsan is a writer at InvestorPlace. He is a self-taught investor with a focus on growth and cyclical stocks that have strong fundamentals, value, and long-term potential. He also has an interest in high-risk, high-reward investments such as cryptocurrencies and penny stocks. You can follow him on LinkedIn.

More From InvestorPlace

The #1 AI Investment Might Be This Company You’ve Never Heard Of

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

It doesn’t matter if you have $500 or $5 million. Do this now.

The post 3 High-Margin Stocks Swimming in Record Profits appeared first on InvestorPlace.

雅虎香港財經

雅虎香港財經