Airline Stock Roundup: JBLU's Improved Q2 Revenue View, RYAAY's Rosy May Traffic

In the past week, JetBlue Airways JBLU management stated that it expects lower costs and a softer revenue decline in the second quarter of 2024. European carrier Ryanair Holdings RYAAY reported upbeat traffic numbers for the month of May, driven by buoyant air travel demand.

Delta Air Lines. DAL also featured in the news, courtesy of management’s decision to resume flights to Tel Aviv following a hiatus of around eight months due to the Hamas terror attack and war in Gaza. Spirit Airlines SAVE announced the appointment of Brian McMenamy, vice president and controller, as its chief financial officer on an interim basis.

Recap of the Most Important Stories

1 JetBlue now anticipates its second-quarter revenues to decline between 6.5% and 9.5% year over year, which marks an improvement from the previous guidance of a 6.5% to 10.5% decline. Capacity or available seat miles are now anticipated to decline in the 2-4% range. This marks an improvement over the prior forecast of a decline in the 2-5% band. JBLU now anticipates non-fuel unit costs to increase 5-7%, down from the prior expectation of a 5.5-7.5% increase. JetBlue now anticipates second-quarter 2024 average fuel cost per gallon in the range of $2.85-$2.95 (prior view: between $2.98 and $3.13).

JBLU currently carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

2. The number of passengers transported on Ryanair flights was 18.9 million in May 2024, reflecting an 11% year-over-year increase. RYAAY’s traffic in May was much more than the April reading of 17.3 million and the March reading of 13.6 million. May load factor (percentage of seats filled by passengers) improved to 95% from 94% in the year-ago period.

An update on air traffic was also available in the previous week's write-up.

3. Delta announced its intention to resume flights to Israel from Jun 7. DAL has not operated flights to Israel since Oct 7, 2023, due to the Hamas terror attack and war in Gaza. Its flights on the New York-JFK – Tel Aviv route will be operated by an Airbus A330-900neo that offers customers nearly 2,000 seats on a weekly basis.

The decision to resume nonstop flights to Israel comes after an extensive security risk assessment by Delta Air. The airline continues to closely monitor the situation in Israel in conjunction with the government and private-sector partners. The flights will operate on a daily basis.

4. Spirit Airlines has chosen its vice president and controller, Brian McMenamy, as the interim chief financial officer (CFO) of the company, effective Jun 14, 2024. McMenamy is succeeding Scott Haralson, executive vice president and CFO, who has been serving the company for almost 11 years. McMenamy joined SAVE in 2017.

Performance

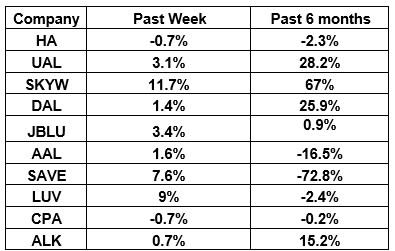

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks traded in the green over the past week. The NYSE ARCA Airline Index increased 1.5% $59.41. Over the course of the past six months, the NYSE ARCA Airline Index declined 4.6%.

What’s Next in the Airline Space?

With the first-quarter 2024 earnings season over for airlines, the focus will once again shift to news-related updates. Air travel demand is buoyant, as exemplified by the busy Memorial Day weekend and the Airlines for America’s upbeat for this summer. The International Air Transport Association’s bullish forecast on current-year profitability for airlines across the globe is also based on upbeat passenger volumes. To match the buoyant demand scenario, updates pertaining to the expansion of capacity by various carriers cannot be ruled out in the coming days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經