Colgate (CL) Benefits From Innovation and Pricing Strategies

Colgate-Palmolive Company CL is well-placed for long-term growth backed by its business strategy of increasing its leadership in key product categories through innovation in core businesses, tracking adjacent categories’ growth and expansion into new markets and channels. CL has been ranked the leading consumer goods company, with a global household penetration of 61.6%.

Aggressive pricing actions and robust consumer demand, along with solid business momentum, have been the key to the earnings success of this global leader in the oral care hygiene market. In addition, accelerated revenue growth management plans have been bolstering organic sales of Colgate, with first-quarter 2024 organic sales increasing 9.8%.

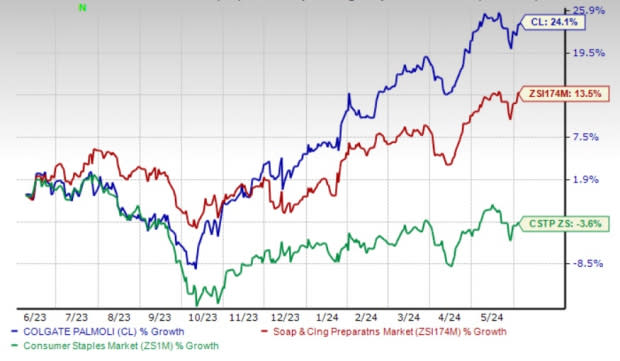

Shares of this current Zacks Rank #3 (Hold) company have gained 24.1% in the past year compared with the industry’s 13.5% growth. The consumer goods company also compared favorably with the sector’s decline of 3.6%.

The Zacks Consensus Estimate for CL’s current financial-year sales and earnings indicates growth of 3.9% and 9.3%, respectively, from the year-ago reported numbers.

Image Source: Zacks Investment Research

What Places CL Well?

Colgate-Palmolive has been gaining from continued strong pricing and the benefits of funding growth and other productivity initiatives. It has been implementing aggressive pricing for the last few quarters, which boosted margins in first-quarter 2024.

The company has adopted aggressive pricing mainly to combat the inflation in raw materials, particularly agricultural products. Colgate, on its last reported quarter’s earnings call, revealed its expectations to witness a moderation in agricultural prices going into 2024. Consequently, it anticipates a moderation in the pricing for its products and a rebound in volume growth, thereby driving household penetration in its markets.

In the quarters ahead, CL foresees gross profit margin expansion on both GAAP and adjusted basis, driven by continued pricing gains, benefits from revenue growth management initiatives and strength in the funding-the-growth program.

Colgate continues to witness market share momentum, backed by strong innovation and higher levels of brand investment, with a focus on enhancing the efficacy of every dollar spent. The company’s innovation strategy is focused on growing in adjacent categories and product segments. It is also focused on the premiumization of its Oral Care portfolio through major innovations.

Additionally, CL’s progress on its digital transformation endeavors, along with the finest data analytics, bodes well for continued improvement in revenues and profitability. We are also optimistic about the company’s revenue growth management initiatives, which will position it well for growth in several quarters ahead.

Hiccups

Colgate has been witnessing headwinds related to inflation and the challenging macroeconomic environment. Raw material inflation and the continued rise in packaging have been acting as a deterrent to the company’s profitability. Continued volume softness in China and the headwind from lower private label growth with the transfer of more of Hill’s volume into the pet nutrition manufacturing network also impacted sales in the recent quarters.

Also, the foreign currency fluctuations are concerning. The sales view for 2024 includes a mid-single-digit negative impact of currency.

Stocks to Consider

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely Freshpet FRPT, Vital Farms VITL and PepsiCo Inc. PEP.

Freshpet is a pet food company. The company manufactures and markets natural fresh foods, refrigerated meals, and treats for dogs and cats in the United States and Canada. It has a trailing four-quarter earnings surprise of 118.2%, on average. FRPT currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Freshpet’s current financial-year sales and earnings indicates growth of 24.8% and 177.1%, respectively, from the prior-year reported level.

Vital Farms offers a range of produced pasture-raised foods. VITL currently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 102.1%, on average.

The consensus estimate for Vital Farms’ current financial year’s sales and earnings per share indicates growth of 22.5% and 59.3%, respectively, from the year-ago reported figures.

PepsiCo, a leading global food and beverage company, currently carries a Zacks Rank #2 (Buy). PEP has a trailing four-quarter earnings surprise of 5.1%, on average.

The Zacks Consensus Estimate for PEP’s current financial-year sales and earnings indicates growth of 3.6% and 7.1%, respectively, from the year-earlier actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Freshpet, Inc. (FRPT) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經