Does Fortinet's (FTNT) Cybersecurity Strength Make It a Buy?

Fortinet FTNT has emerged as a leading cybersecurity company, offering a comprehensive suite of solutions to protect organizations from the ever-evolving threat landscape.

The cybersecurity market is projected to continue to grow at a rapid pace, driven by the increasing frequency and sophistication of cyber threats.

According to a report by MarketsandMarkets, the global cybersecurity market is expected to reach $308.8 billion by 2024, at a growth rate of 10% year over year.

Higher IT spending on cybersecurity is further expected to aid Fortinet in growing faster than the security market. Worldwide IT spending is projected to reach $5.1 trillion in 2024, up 8% year over year.

Fortinet’s ability to provide end-to-end protection, advanced threat detection and response capabilities, and robust multi-cloud support sets it apart from its competitors. Its focus on performance, scalability and continuous innovation through its FortiGuard Labs further enhances its competitive edge.

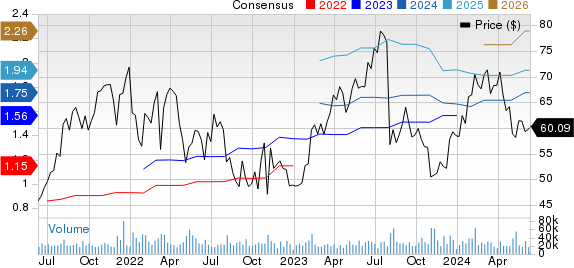

Fortinet, Inc. Price and Consensus

Fortinet, Inc. price-consensus-chart | Fortinet, Inc. Quote

Fortinet's Solid Security Portfolio Boosts Growth Prospects

At the core of Fortinet's value proposition is its Security Fabric, a broad, integrated, and automated cybersecurity platform designed to provide end-to-end protection across networks, endpoints, applications and multi-cloud environments. This holistic approach addresses the complexities of modern cybersecurity challenges, where threats can originate from multiple vectors.

The Security Fabric comprises several key products, including FortiGate next-generation firewall, a powerful and scalable solution that combines traditional firewall capabilities with advanced security features such as intrusion prevention, application control and SSL/TLS inspection.

Its FortiWeb Web Application Firewall (WAF) and FortiMail Email Security solutions are widely recognized for their effectiveness in protecting against web-based attacks and email-borne threats, respectively. Fortinet's portfolio also includes the FortiSIEM (Security Information and Event Management) solution, which provides centralized visibility and threat detection across an organization's entire IT infrastructure.

Furthermore, Fortinet's commitment to innovation has led to the development of cutting-edge technologies, such as its AI-powered FortiGuard Labs, which provides real-time threat intelligence and advanced threat detection capabilities. FortiAI, the GenAI assistant, aids security and network operations teams by facilitating faster threat investigation and remediation and simplifying network configuration and management through its intuitive interface.

Besides, Fortinet's products are designed to be highly scalable and performant, capable of handling the demands of large enterprises and service providers. Fortinet’s multi-cloud approach ensures that organizations can maintain a robust security posture regardless of their infrastructure's complexity. The company's solutions are widely adopted by enterprises, service providers and government organizations worldwide, underscoring the trust and confidence in its portfolio.

Fortinet's strong portfolio has translated into impressive financial performance. In the first quarter of 2024, the company reported revenues of $1.26 billion, representing a year-over-year increase of 32.9%. Its billings grew 34.1% year over year, indicating strong demand for its solutions.

For fiscal 2024, FTNT expects revenues in the range of $5.745-$5.845 billion and an operating margin of 26.5- 28%. Service revenues are projected in the range of $3.94-$3.99 billion, indicating growth from Unified SASE and SecOps.

The Zacks Consensus Estimate for revenues in fiscal 2024 is pegged at $5.79 billion, suggesting growth of 9.2% year over year. The consensus estimate for earnings is pegged at $1.75 per share, indicating 7.4% year-over-year growth.

Conclusion

Fortinet's strong portfolio, characterized by its comprehensive Security Fabric, advanced threat detection and response capabilities, multi-cloud support and continuous innovation, positions the company as a formidable player in the cybersecurity industry.

Fortinet has also made strategic acquisitions to expedite growth. It is set to acquire Lacework, a data-driven cloud security company that delivers a leading AI-powered cloud security platform that seamlessly integrates all critical CNAPP services. Fortinet intends to integrate Lacework’s CNAPP solution into its existing portfolio, forming one of the most comprehensive, full-stack AI-driven cloud security platforms available from a single vendor.

However, the company faces competition from other established players such as Palo Alto Networks PANW, Check Point Software Technologies CHKP and Cisco Systems CSCO. These competitors also offer comprehensive security solutions and are continuously investing in innovation to stay competitive.

Fortinet shares have gained 2.7% year to date, underperforming the Zacks Computer and Technology sector’s rise of 19%.

Moreover, FTNT is trading at a premium with a forward 12-month P/S of 7.5X compared with the Zacks Internet Software industry’s 2.6X, reflecting a stretched valuation.

Hence, investors should wait for a better entry point for Fortinet, which currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Check Point Software Technologies Ltd. (CHKP) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經