Axcelis (ACLS) Sets Up Service Offices for Customers in Japan

Axcelis Technologies, Inc. ACLS recently expanded business operations in Japan by setting up new service offices in June 2024. The service offices, located in Chitose, Hokkaido and Kumamoto, Kyushu, will support the ACLS’ growing client base in the country.

ACLS noted that its service centers are located near the customers, which will facilitate localized support resources for the Purion ion implant equipment, which is in production.

In Japan, Axcelis has been forging business partnerships with Silicon and Silicon Carbide (SiC) semiconductor power device clients. In April 2024, ACLS shipped Purion EXE SiC high energy implanter and Purion H200 SiC medium energy implanter evaluation closure to several Japan-based power device chipmakers. These solutions will be utilized for 150mm and 200mm production of silicon-carbide power devices for a wide range of applications across various sectors like automotive, industrial and energy.

Management also remains focused on expanding its market share. Apart from the shipments to device makers in Japan, the company also shipped numerous shipments of Purion M SiC medium current implanter to China-based power device chipmakers in March 2024.

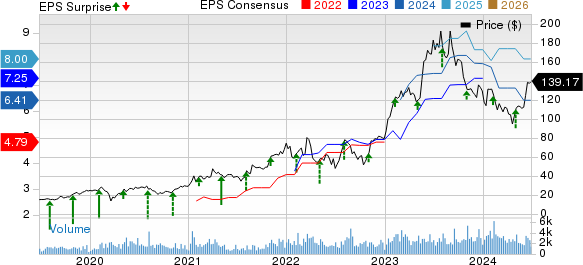

Axcelis Technologies, Inc. Price, Consensus and EPS Surprise

Axcelis Technologies, Inc. price-consensus-eps-surprise-chart | Axcelis Technologies, Inc. Quote

Axcelis is a leading producer of ion implantation equipment used in the fabrication of semiconductors. Robust customer demand for Purion suite of products, especially in the silicon-carbide power market, is driving the company’s top line.

The Purion suite of ion implanters is designed to address the challenges of fab processes at 10nm or less. All Purion ion implanters have a standard, high-performance platform embedded with three beamline technologies to meet the requirements of High Current, Medium Current and High Energy applications. The platform is capable of delivering a throughput of up to 500 WPH, noted ACLS.

In the last reported quarter, revenues of $252.4 million beat the Zacks Consensus Estimate by 4%. Healthy shipments to China, coupled with impetus in the implant-intensive power device segment, notably silicon carbide, drove top-line growth.

System revenues generated $195.4 million in the reported quarter. In the first quarter of 2024, 99% of shipped system revenues came from mature process technology which includes power devices.

However, weakness in the general mature market and memory markets is a concern. Lower fab utilization is affecting Customer Solutions & Innovation (CS&I) revenues. ACLS now expects CS&I revenues to be approximately $250 million in 2024.

At present, ACLS carries a Zacks Rank #4 (Sell). Shares of the company have lost 20.3% in the past year compared with the 10.8% growth of the sub-industry.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks worth consideration in the broader technology space are NVIDIA Corporation NVDA, Arista Networks ANET and Woodward WWD, currently sporting a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA’s fiscal 2025 EPS is pegged at $2.68, which increased 12.1% in the past 60 days. NVIDIA’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 18.4%. The long-term earnings growth rate is 37.6%. Shares of NVDA have risen 207.4% in the past year.

The Zacks Consensus Estimate for Arista Network’s 2024 EPS is pegged at $7.92, which increased 5.7% in the past 60 days. The long-term earnings growth rate is 16.1%. ANET’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 15.4%. Shares of ANET have gained 114.7% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 EPS has increased 11.6% in the past 60 days to $5.88. WWD’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 26.1%. The long-term earnings growth rate is 16.5%. Shares of WWD have risen 51.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經