Here's Why Investors Should Bet on Enersys (ENS) Stock Now

EnerSys ENS is poised to gain from strength in the Motive power segment, accretive acquisitions and shareholder-friendly moves.

Let’s delve into the factors that make this Zacks Rank #2 (Buy) company a smart investment choice at the moment.

Business Strength: EnerSys has been witnessing strength in its Motive power segment, driven by increased orders for its products in the electric industrial forklift trucks market. The segment’s revenues increased 3% year over year in the fourth quarter of fiscal 2024. Management expects the Motive Power segment to benefit from strength in automation and electrification markets.

In the quarters ahead, EnerSys is poised to benefit from its solid product offerings, a firm focus on product innovation (including lithium, Touch-Safe, CPUC and DC fast charge) and strengthening demand. Technological expertise and effective pricing are other tailwinds. The company strengthened its position as a leading provider of NexSys Thin Plate Pure Lead products in the past few years. The global megatrends including 5G expansion, rural broadband build-outs, electrification, automation and decarbonization are beneficial.

Expansion Efforts: Over time, ENS has steadily strengthened its business through acquisitions. In May 2024, EnerSys inked a deal to acquire Bren-Tronics, Inc. in an all-cash deal of $208 million. The acquisition will strengthen the company’s position as a critical enabler of the energy transition and support its growth in the growing military and defense end market. The acquisition is expected to close in the second quarter of 2024.

In April 2023, EnerSys acquired the UK-based battery service and maintenance provider, Industrial Battery and Charger Services Limited (“IBCS”). The addition of IBCS has bolstered the company’s motive power service offerings and strengthened its presence in the UK market. It also augmented its comprehensive range of battery-related services including installation and maintenance to repair and replacement. Acquisitions had a positive impact of 1% on the Motive Power segment’s sales growth in the fiscal fourth quarter (ended March 2024).

Rewards to Shareholders: EnerSys continues to increase shareholders’ value through dividend payments and share repurchases. The company paid out dividends of $34.5 million in fiscal 2024. It also bought back shares worth $95.7 million. EnerSys hiked its quarterly dividend by 29% to 22.5 cents per share in August 2023. In March 2022, the company announced a share repurchase program worth $150 million. The buyback program has no expiration date. Exiting the fiscal fourth quarter, the company was left to repurchase shares worth $98.9 million in aggregate.

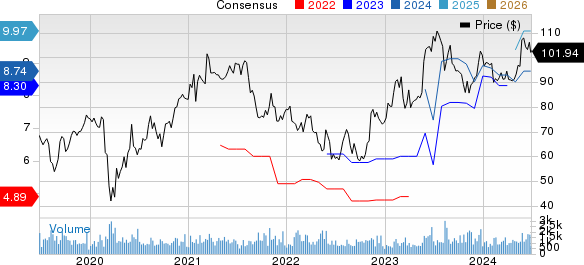

Northward Estimate Revision: In the past 60 days, the Zacks Consensus Estimate for ENS’ fiscal 2025 (ending March 2025) earnings has been revised 3.9% upward.

Enersys Price and Consensus

Enersys price-consensus-chart | Enersys Quote

Other Stocks to Consider

Some other top-ranked companies from the Industrial Products sector are discussed below:

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter average earnings surprise of 8.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AIT’s fiscal 2024 earnings has improved 0.9% in the past 60 days. The stock has risen 11% in the year-to-date period.

Belden Inc. BDC presently carries a Zacks Rank of 2 and has a trailing four-quarter earnings surprise of 14.7%, on average.

The consensus estimate for BDC’s 2024 earnings has increased 8.3% in the past 60 days. Shares of Belden have gained 20.4% in the year-to-date period.

Crane Company CR presently carries a Zacks Rank of 2. CR delivered a trailing four-quarter earnings surprise of 15.2%, on average.

The Zacks Consensus Estimate for CR’s 2024 earnings has increased 0.8% in the past 60 days. Its shares have gained 21.3% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Belden Inc (BDC) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經