Microchip (MCHP) Bolsters Edge AI With Neuronix Acquisition

Microchip Technology MCHP recently increased its expertise in power-efficient, AI-enabled edge solutions with the acquisition of Neuronix AI Labs.

MCHP aims to improve its offerings for field programmable gate arrays (FPGAs) by leveraging Neuronix’s neural network sparsity optimization technology, notably its mid-range PolarFire FPGAs and SOCs, renowned for their low-power consumption, reliability and security.

The acquisition positions Microchip to build cost-effective, large-scale edge deployments tailored for computer vision applications while addressing constraints in costs, size, and power.

The integration of Neuronix AI’s intellectual property with Microchips' existing compilers and software design kits promises to simplify the implementation of AI/ML algorithms on customizable FPGA logic without the need for resistor transition level (RTL) FPGA design expertise.

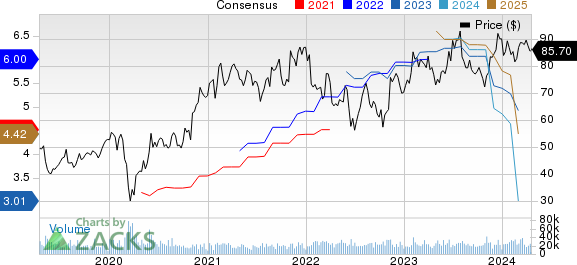

Microchip Technology Incorporated Price and Consensus

Microchip Technology Incorporated price-consensus-chart | Microchip Technology Incorporated Quote

Moreover, the acquisition enables convolutional neural networks (CNNs) updates and upgrades without the need for hardware reprogramming, simplifying the deployments and maintenance of AI-driven solutions for a broader range of users.

Microchip Benefits from a Strong Portfolio

MCHP’s acquisition of Neuronix AI Labs aims to bolster its power-efficient, AI-enabled edge solutions on FPGA platforms, catering to growing demands for cost-effective, large-scale deployments in computer vision applications.

In the third quarter of fiscal 2024, MCHP achieved Qualified Manufacturers List (QML) Class Q certifications for radiation-tolerant PolarFire FPGAs, which provide high density and performance for space applications with low-power consumption and immunity to configuration upsets.

Acquisitions have been a key catalyst in boosting MCHP’s overall portfolio. It recently completed the acquisition of VSI Co. Ltd., strengthening its position in providing high-speed, asymmetric camera, sensor and display connectivity for in-vehicle networking, aligning with Automotive SerDes Alliance (ASA) open standard to meet the growing demand for next-generation vehicles.

MCHP is also riding on consistent strength in its microcontroller business. It has recently announced the launch of the AVR DU family of microcontrollers, offering enhanced USB connectivity, power delivery, security features and cost-saving benefits for embedded designs.

Microchip also introduced the AVR EB family of microcontrollers to mitigate noise, vibration, and system harness in BLDC motor applications, providing a smaller, more cost-effective solution for sophisticated waveform control and increased efficiency.

Despite MCHP’s robust portfolio, persistent inflationary pressures and high-interest rates have resulted in a weak macro environment.

Microchip expects net sales to be $1.225-$1.425 billion for the fourth quarter of fiscal 2024. Non-GAAP earnings are anticipated between 46 cents per share and 68 cents. The Zacks Consensus Estimate for revenues is pegged at $1.33 billion, indicating a 40.57% year-over-year decline.

The consensus mark for earnings is pegged at 57 cents per share, suggesting a 65.24% year-over-year decline.

Zacks Rank & Stocks to Consider

Microchip currently has a Zacks Rank #5 (Strong Sell).

MCHP’s shares have dropped 5% year to date against the Zacks Computer & Technology sector's rise of 11.1%.

Some better-ranked stocks in the broader technology sector are NetApp NTAP, Bentley Systems BSY and NVIDIA NVDA, each sporting Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NetApp shares have gained 16.1% in the year-to-date period. NTAP’s long-term earnings growth rate is currently projected at 8.79%.

Bentley Systems shares have declined 8.9% in the year-to-date period. BSY's long-term earnings growth rate is currently projected at 12%.

NVIDIA shares have gained 73.1% in the year-to-date period. NVDA's long-term earnings growth rate is currently projected at 30.93%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Bentley Systems, Incorporated (BSY) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經