TotalEnergies (TTE) to Sell West of Shetland Assets to Prax Group

TotalEnergies SE TTE announced that it has signed an agreement to sell its entire interest in West of Shetland assets in the United Kingdom to The Prax Group. The transaction is subject to approval from the relevant authorities.

Currently, TotalEnergies' portion of these mature assets produces around 7,500 barrels of oil equivalent per day (boe/d), 90% of which is gas.

Acquisition & Divestiture in Oil and Energy Space

TotalEnergies continues with its strategic acquisitions in high-potential areas and sells non-core assets to achieve its long-term objective of improving production by focusing on the promising hydrocarbon-producing regions of the world.

This deal is in line with TTE's plan to focus on its most promising assets and aggressively manage its portfolio by monetizing its older holdings. The recent announcement followed TotalEnergies’ previous communication regarding an agreement with Hibiscus Petroleum Berhad to sell its subsidiary TotalEnergies EP (Brunei) B.V. for $259 million.

In first-quarter 2024, TTE acquired and sold assets worth $1.07 billion and $1.57 billion, respectively. These strategic initiatives should assist the company to further expand its operations across the globe.

Along with TTE, other oil and gas companies like Petrobras PBR, BP plc BP and Murphy Oil Corporation MUR are also divesting non-core assets and making strategic acquisitions to further expand operations and benefit from core operations.

In April 2024, Petrobras announced a significant divestment move. The company sold its entire stake in the Cherne and Bagre fields, located in the shallow waters of Brazil’s Campos basin, to Perenco Petróleo e Gás do Brasil Ltda for $10 million. This divestment aligns with Petrobras’ overarching strategy of optimizing its portfolio and directing investments toward assets that better resonate with its long-term objectives.

PBR’s long-term (three- to five-year) earnings growth rate is 26.94%. The Zacks Consensus Estimate for 2024 earnings per share (EPS) indicates a year-over-year decrease of 17%.

BP is focused on selling non-core assets to streamline its operations, lower its debt burden and fund investments in sustainable energy projects. This year, the British energy giant anticipates to generate $2-$3 billion from divestments and other proceeds. Alongside its first-quarter results announcement, BP stated that since the second quarter of 2020, it has realized $18.2 billion in divestment and other proceeds. The energy major is confident about its ability to achieve its goal of $25 billion in divestment and other proceeds between the latter half of 2020 and 2025.

BP’s long-term earnings growth rate is 4%. The Zacks Consensus Estimate for 2024 sales indicates a year-over-year increase of 13.5%.

In 2023, Murphy Oil’s subsidiary closed the divestment of certain non-core-operated Kaybob Duvernay assets and all of its non-operated Placid Montney assets in Canada. The company received cash proceeds of nearly $104 million. MUR intends to utilize the proceeds from non-core asset divestitures in its new business in Côte d’Ivoire and development in Vietnam.

The Zacks Consensus Estimate for MUR’s 2024 sales indicates a year-over-year decrease of 2.2%. The company delivered an average earnings surprise of 3.3% in the last four quarters.

Price Performance

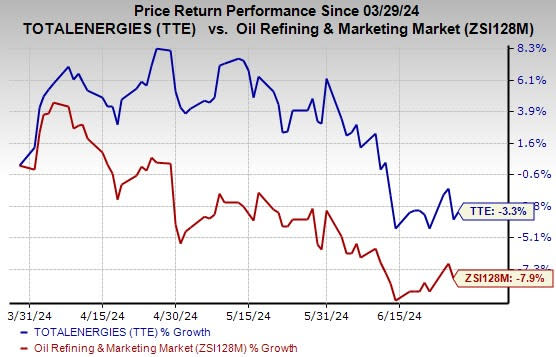

In the past three months, shares of TotalEnergies have lost 3.3% compared with the industry’s 7.9% decline.

Image Source: Zacks Investment Research

Zacks Rank

The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP): Free Stock Analysis Report

Petroleo Brasileiro S.A.- Petrobras (PBR): Free Stock Analysis Report

Murphy Oil Corporation (MUR): Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE): Free Stock Analysis Report

雅虎香港財經

雅虎香港財經