Walmart (WMT) Up More Than 30% in a Year: Further Growth Ahead?

Walmart Inc.’s WMT incredible growth story can be narrated by its strong omnichannel initiatives and highly diversified business. The retail behemoth continues to thrive with increased traffic in both physical stores and digital platforms, demonstrating its ability to adapt and innovate in an evolving retail landscape.

Strengths like these, along with a budding advertising business, fueled Walmart’s first-quarter fiscal 2025 results, wherein the top and bottom lines increased year over year, and e-commerce penetration grew across all markets. Encouragingly, management raised its guidance for fiscal 2025.

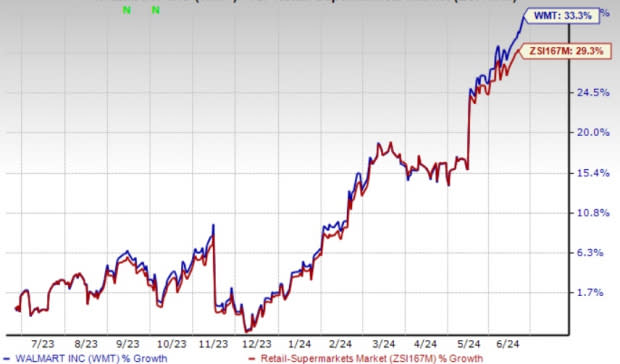

The Zacks Consensus Estimate for fiscal 2025 earnings per share (EPS) has risen by a penny to $2.42 over the past 30 days. The consensus mark suggests growth of around 9% from the year-ago period figure. Markedly, this Zacks Rank #2 (Buy) stock has rallied 33.3% in the past year, outpacing the industry’s growth of 29.3%. In the past three months, the company’s shares have risen 13.9%.

Image Source: Zacks Investment Research

A Closer Look at the Growth Drivers

Walmart continued to showcase a robust performance in the first quarter of fiscal 2025, demonstrating substantial growth and market share gains. The company's commitment to innovation and adaptability, particularly in the e-commerce space, has been a major driver. Gains from higher-margin ventures, such as advertising, are also noteworthy. Walmart’s global advertising business increased around 24% in the first quarter. Together, these upsides reinforce the company’s position as a retail powerhouse with a keen eye on sustained success and customer engagement.

Walmart continues to be driven by its strong omnichannel business. From investing in pioneering data analytics to expanding its digital presence and optimizing in-store operations, the company leaves no stone unturned. Impressive store proximity to customers has allowed Walmart to use its stores to fulfill e-commerce orders. The company has undertaken several initiatives to enhance e-commerce operations, including buyouts, alliances, and improved delivery and payment systems.

In the first quarter of fiscal 2025, global e-commerce sales surged 21% on store-fulfilled pickup & delivery and marketplace and formed 18% of Walmart’s overall net sales.

Walmart has significantly bolstered its delivery capabilities, as exemplified by its Express On-Demand Early Morning Delivery service, Spark Driver platform, the partnership with Salesforce, the expansion of the InHome delivery service, investments in DroneUp and the Walmart+ membership program, to name a few. WMT’s store and curbside pickup options add to customers’ convenience. As of the first quarter of fiscal 2025, Walmart U.S. had nearly 4,600 pickup locations and about 4,300 same-day delivery stores.

Rosy Days to Continue?

Walmart's strategic initiatives, robust performance and commitment to innovation position it well for sustained growth and market leadership. In its first-quarter earnings release, management stated that it anticipates being at the upper end or slightly higher than its earlier net sales, adjusted operating income and adjusted EPS guidance for fiscal 2025.

For fiscal 2025, Walmart had earlier expected consolidated net sales growth in the 3-4% range at cc. Consolidated operating income growth was previously expected to come in the range of 4-6% at cc. Walmart had earlier envisioned adjusted EPS for fiscal 2025 to come in the $2.23-$2.37 band compared with $2.22 recorded in fiscal 2024.

For the second quarter of fiscal 2025, the company anticipates consolidated net sales to increase 3.5-4.5% at cc. Consolidated operating income is expected to rise 3-4.5% at cc.

All said, we expect Walmart to continue with its remarkable growth story.

3 Other Strong Bets

Abercrombie & Fitch ANF, a specialty retailer, currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for ANF’s current financial-year sales and earnings suggests growth of 10.4% and 47.3%, respectively, from the year-ago reported numbers. You can see the complete list of today’s Zacks #1 Rank stocks here.

Abercrombie & Fitch has a trailing four-quarter earnings surprise of 210.3%, on average.

Macy's, Inc. M, an omnichannel retail organization, currently sports a Zacks Rank #1. The Zacks Consensus Estimate for M’s current fiscal quarter’s earnings per share implies growth of 15.4% from the year-ago period number.

Macy's has a trailing four-quarter earnings surprise of 57.1%, on average.

Tractor Supply TSCO, a rural lifestyle retailer, currently carries a Zacks Rank #2. The Zacks Consensus Estimate for TSCO’s current financial-year sales and earnings indicates respective growth of about 3% and 2.5% from the year-ago reported number.

Tractor Supply has a trailing four-quarter earnings surprise of 2.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

雅虎香港財經

雅虎香港財經